Hirst NFT release: is this the future of Fine Art?

We probably wouldn’t be the first to say that Hirst is quite skilled at being both the easy to like artist as well as the controversial, market-shaking one. In this instance we want to focus on a very particular series: his latest NFT release- ‘The Currency’. It hit the art market like a hurricane in July and left us with lots of questions regarding the future of the Fine Art market. What’s so interesting about ‘The Currency’?- you may be wondering. Well...let’s find out!

‘The Currency’ explained

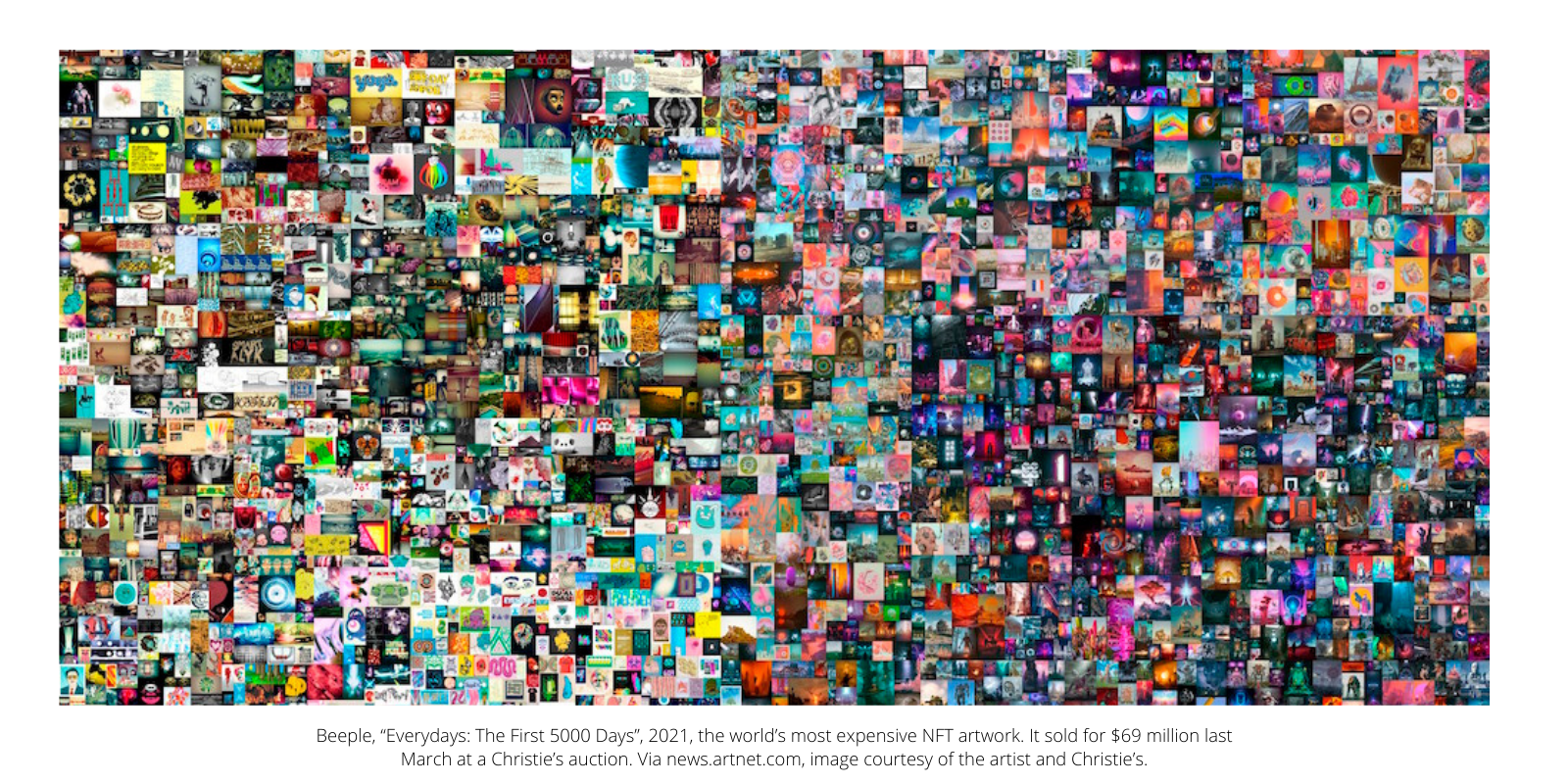

‘The Currency’ is a collection of 10,000 NFTs - yes, that many! Not a Beeple 5,000 works kind of thing- it’s a Hirst, so you have got to expect a little more than that. Like any other NFT (non-fungible token) out there, each NFT in this collection is linked to an artwork. However, unlike most NFTs, which are linked to digital artworks, these NFTs are linked to physical Fine Art pieces - each work is made up of colourful dots from one consistent colour palette on handmade paper (which, coincidentally are the same dimensions as the old fashioned cheques from the bank!). Although very similar, each work is made unique by having their own composition, title and a plethora of other rarities such as “unique spot patterns, density and drips, but also they have other ‘currency-like’ details such as a watermark and a hologram of Hirst’s head”. So far so good, yes? Well… there is a twist: within one year of ownership of their NFT, the buyers must decide whether they keep the NFT or trade it in for the physical artwork it represents; under no circumstances can they keep both. Keeping the physical piece means destroying the NFT, whereas keeping the NFT means… yes, you guessed it - one less ‘tangible’ Hirst artwork under the sun.

What does this mean for the Fine Art market?

NFTs have received mixed responses on the art scene and among the collecting crowd, with many physical art collectors questioning NFTs’ popularity, and suggesting that this form of collecting might not ever take hold. Their argument is that reasons for collecting encompass more than just ‘ownership’ or ‘investing’ motivations. While an NFT can be conveniently stored and easily traded, its digital form might be a deal-breaker for collectors who crave the sensorial experience of Art - particularly Fine Art, where physical presence (form and materials) are so important. NFTs will never have the same impact as physical art to these collectors, at least.

‘The Currency’ series is now giving both more avant-garde and traditional collectors an opportunity to coexist by presenting them all with a choice between the physical or the digital artwork. The choices they ultimately make present an interesting experiment and a glimpse into how the traditional Fine Art market might adapt to the digital advances towards NFTs and cryptocurrencies.

How are galleries coping with this development?

“You look at what’s happening in NFTs, and you can kind of see the galleries disappearing before you see the NFTs disappearing”

- Damien Hirst speaking on ‘Squawk Box’, CNBC

After coming across Hirst’s interview for CNBC, we were wondering how real the concern is around galleries being under threat from NFTs or if this is purley part of a carefully crafted PR message shaped by Hirst's team to promote his work. We can see that he has a point, but will galleries stop existing in the near future? Before giving an answer here,, there are a few things to consider: why do galleries exist? The most straightforward answer is obviously to sell art. Though, are galleries really becoming obsolete just because of NFTs? No, of course not! If this were to happen, it would have happened already. The artworld has increasingly become more and more digitised, and nowadays, most art sales happen online; yet, art galleries are still putting forward art to sell, as usual. To this, we can already see that galleries exist for more reasons than just to sell art.

Art galleries are the backbone of the artworld, and they play a crucial role in supporting an artist's creative career. A big part of the gallery business model has to do with credibility and prestige. Like a brand, when a blue-chip gallery lends its name to an artist, it has traditionally increased its value. It is easy for Hirst to claim that galleries will become obsolete because he has already benefited from the traditional model. And so releasing new works as NFTs while surpassing the intermediary touchpoint of the gallery is easy for him - Hirst is one the most famous and most prosperous living artists in the world! It's not like he has emerged into the art market now. Now think about an emerging artist with no affiliation to an art gallery or a good network; Do you think this artist is going to reach Hirst's spotlight by purely selling NFTs on his own? The chances are extremely low!

Yes, NFTs facilitate certain parts of the process, but at the end of the day, NFTs differ little from your paintbrush or canvas- it's simply a tool. So, thinking that NFTs will rule the world, abolish art galleries and simplify an artist's career...stop "daydreaming".

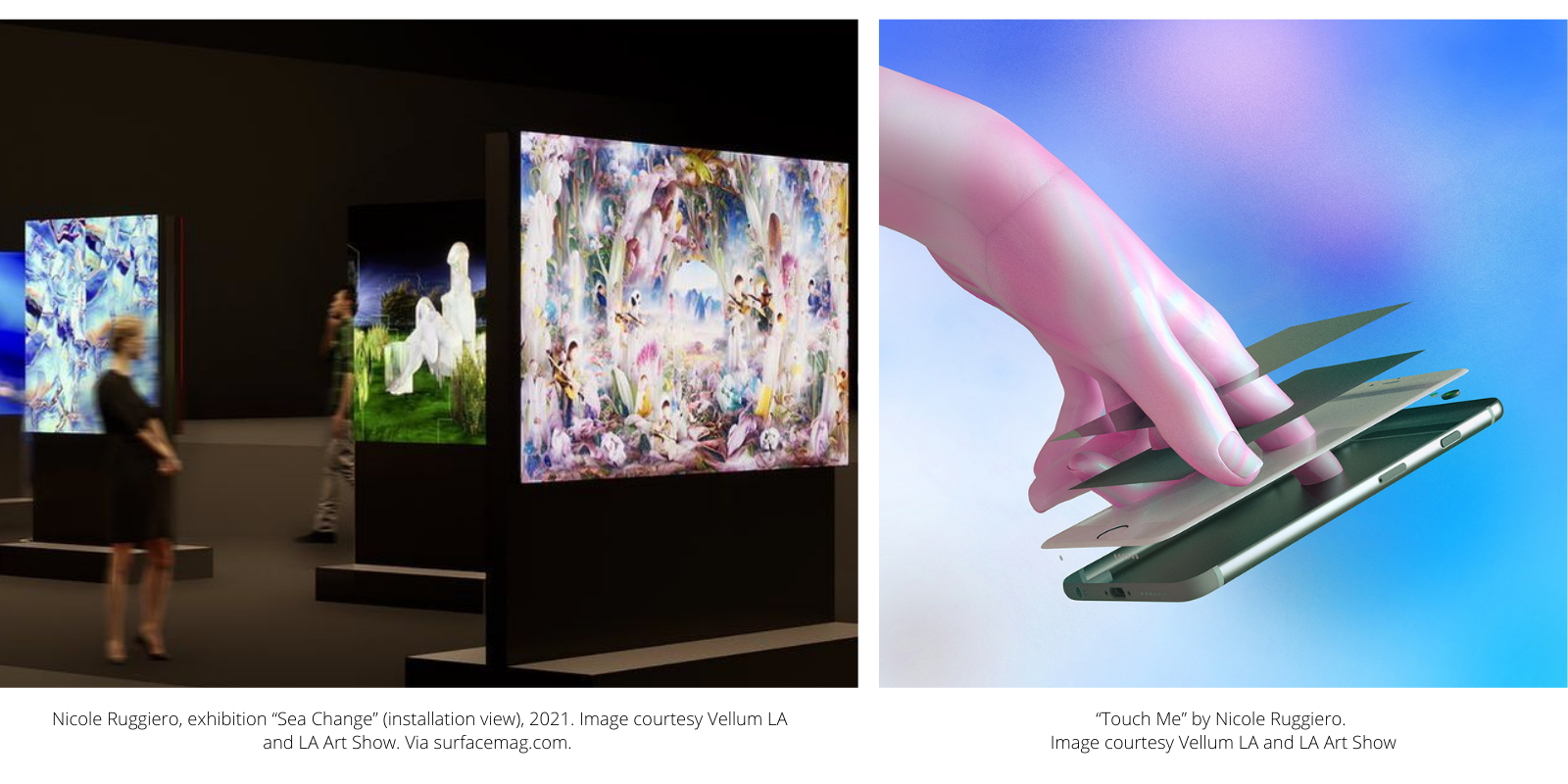

Furthermore, galleries are making considerable efforts to step up their NFTs' game' - for instance, by showing NFT artworks in their physical spaces using high-resolution screens. Even new galleries focus on selling NFT art only, such as Superchief Gallery and Vellum LA. There is still a long way to go to embrace technological progress fully. Nevertheless, we don't see galleries going 'extinct'.

Despite all the uncertainty this creates, we believe the digital and physical realms can coexist and that the Fine Art market can benefit from both.