AI estimates and the case for transparency in art

From expectations to market reality

When collectors consider selling an artwork, one question tends to dominate:

“What could this realistically sell for today?”

Too often, expectations are anchored to the price paid, an old auction result, or informal guidance that isn’t grounded in current market conditions. This gap between expectation and reality is one of the main sources of friction in the selling process.

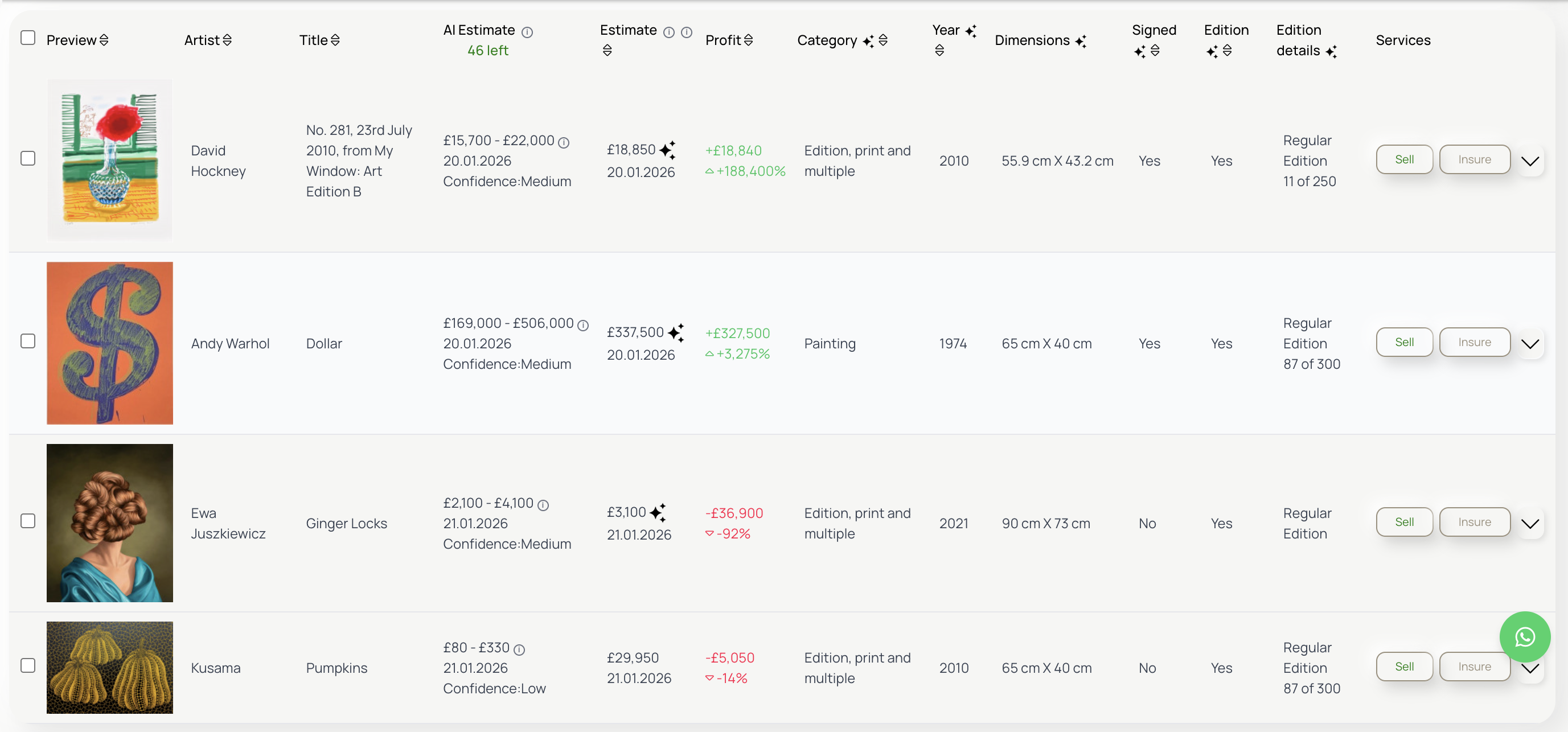

Our AI Estimates have been built and designed to introduce a data-led reference point at this stage — before decisions are made, and before commitments are required. Not a promise. Not a guarantee. A clearer view of market reality.

What “liquid market value” means when selling

When selling an artwork, value isn’t theoretical — it’s practical.

In this context, liquid market value refers to an indicative view of what the market is paying today, based on comparable transactions and importantly for sellers, what a sale would likely realise net, after typical market dynamics are taken into account. It helps collectors assess what outcomes are realistic within current conditions, rather than ideal scenarios.

This lens is different from:

- Insurance values

- Retail or gallery pricing

- Peak prices achieved in exceptional circumstances

For sellers, liquid market value is about optionality and timing, understanding whether now is the right moment to sell, and at what level.

When we talk about value in this context, we’re referring specifically to liquid market value, an indicative view of what the market is paying today, based on comparable transactions. That distinction matters.

Liquid value is different from:

- Insurance value

- Retail or gallery pricing

- The highest price an artwork might achieve under ideal conditions

It’s a pragmatic lens. One that helps collectors think clearly about timing, optionality, and next steps.

How AI Estimates work

AI Estimates are designed to be rigorous without being opaque.

At their core, they analyse historic auction sales for comparable artworks, focusing on the same artist, similar mediums, sizes, and periods, and prioritise relevance and recency when assessing value. Obvious outliers are removed so atypical results don’t distort the picture, and where relevant, adjustments are applied for factors such as editions or signatures. The result is a conservative price range, rather than a single point estimate.

Each estimate also includes a confidence score, reflecting the strength and depth of available comparable data, so collectors can understand not just the output, but the context behind it. In the latest version, the model can also take the artwork itself into account. By leveraging image-based analysis, it can improve how comparable works are identified across artists, styles, and periods, leading to more context-aware results.

The result is a transparent reference point collectors can use before any conversation begins.

How AI Estimates are designed to be used

AI Estimates are deliberately framed as ranges, not single numbers.

They are intended to be:

- Explored independently by collectors

- Used as context before speaking to an advisor

- Interpreted alongside human advice

In practice, this means collectors can arrive at discussions with greater confidence and clearer expectations — and advisors can focus on strategy, nuance, and decision-making rather than defending or softening numbers.

Transparency, in this sense, strengthens relationships rather than undermining them.

Why this matters when selling art

Selling art is often a high-stakes decision, both financially and emotionally.

By bringing structured, data-led insight into the selling journey, collectors can approach the process with clearer expectations, stronger negotiating positions, and greater confidence in their decisions.

AI Estimates don’t replace expert advice or market nuance — but they reduce uncertainty at a critical moment, helping collectors move from consideration to action with clarity.

Try it for yourself

AI Estimates are now available within Artscapy, and can also be tested for free via our chatbot. Whether you’re actively considering a sale, reviewing your collection, or simply curious, the tool is there to provide a clearer view — on your terms.