Alexander Calder market analysis. Is now a good moment to sell? (February 2026)

Last updated: 4 February 2026. Reading time: 9–13 minutes.

Selling an Alexander Calder is a balancing act. You want validation of a strong result, but you also need selective placement and control over the process. The market for Alexander Calder’s art is dynamic yet surprisingly orderly. One moment, a late-career mobile ignites a six-way bidding war; the next, dozens of smaller works change hands quietly within expectations.

Calder’s market today is liquid and stratified. If you understand where your piece sits in the hierarchy and how to route it, you can structure a sale on your terms.

Data note: Unless otherwise noted, all figures reflect public auction results from 2018 through 2025 and may shift as new sales occur. Prices are cited in USD (hammer or reported final price, depending on source) and discussed in the context of patterns relevant to sellers’ decisions.

👉 Click here and get a price range in about 60 seconds.

In this article

- A case study: When a “Blue Moon” lit up the evening sale

- Market structure: What actually sells — from big mobiles to the prints

- Reading the signals: A barometer in the Calder market

- Private sales for control: Why discretion often pays with Calder

- Decision time: Sell now or wait? A framework grounded in data

- Next steps with Artscapy: How to get a secure valuation and sale

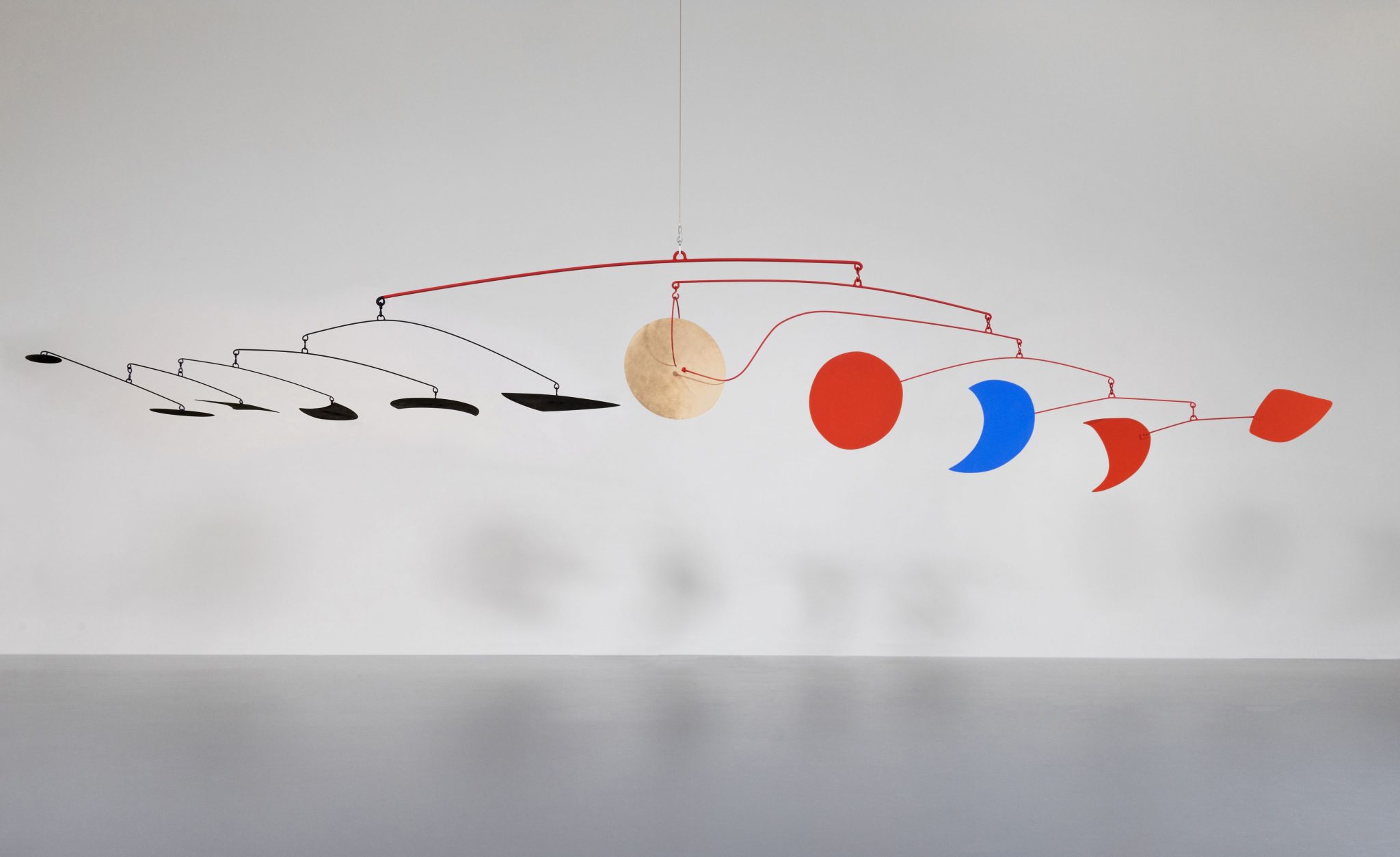

A bidding war for Blue Moon (case study)

In May 2024, the monumental mobile Blue Moon (1962) came to auction with a high estimate of $10 million. Six bidders competed, pushing the final price to $14.4 million — comfortably above expectations.[1] The applause in the room reflected more than the price.

Blue Moon is a late-period work (Calder was in his mid-60s when he created it), a category that seasoned dealers once considered harder to place. “Late Calder used to be unsellable,” remarked Sotheby’s chairman for contemporary art.[1] Yet here was a late Calder outperforming its estimate with global participation.

What changed? Demand — and a broader understanding of quality across periods. Collectors have widened their scope, pursuing strong works from the 1950s and 1960s alongside earlier breakthroughs. The result suggests that even later works can command competition when they offer scale, clarity of composition, and fresh market appearance.

Alexander Calder, Painted Wood, 1962. Image: © Sotheby's

For sellers, the takeaway is practical: buyers reward top-tier Calder pieces regardless of period, provided the work has scale, credible provenance, and visual authority. In this case, Blue Moon combined those attributes with a disciplined estimate that encouraged bidding.[1]

The sale also reinforces Calder’s consistently high sell-through rate. Nearly 90% of Calder lots find buyers at auction, and many exceed expectations. Approximately 45 Calder sculptures trade publicly each year, averaging roughly $2 million, with results frequently landing above estimate ranges.[4]

For sellers, the implication is clear: if your Calder sits within a sought-after category, an auction can deliver a validated result — sometimes an exceptional one. The key is understanding which category you occupy and how the market prioritises it.

How this market works: hierarchy and trends

Calder’s market operates in defined tiers, each with its own pricing logic and buyer profile. At the top are major mobiles and stabiles (unique kinetic sculptures). Beneath them sit unique works on paper and paintings, followed by design objects (notably jewellery), and finally the broad base of prints and multiples.

Liquidity underpins all tiers — a reflection of Calder’s wide collector base and enduring institutional relevance.

Tier 1: Major sculptures

Calder’s hanging mobiles and stabiles anchor the market. These works range from mid-six figures to eight-figure benchmarks. The auction record remains Poisson volant (Flying Fish) at $25.9 million (2014).[3]

In the 2018–2025 dataset referenced here, the median price for a Calder sculpture is approximately $500,000. Many smaller works trade in the mid-six figures, while the ceiling extends much higher.

Recent headline examples include Painted Wood (1943), described as an early seven-foot mobile that achieved approximately $17 million in late 2025,[3] and Blue Moon at $14.4 million.[1]

At this level, buyers, typically established collectors or institutions, scrutinise provenance, exhibition history, scale, and condition. Works with museum exposure or notable collection history tend to command stronger bidding. For example, Painted Wood debuted in Calder’s 1943 MoMA retrospective and came from the collection of Patricia Phelps de Cisneros, a context that supported its positioning.[3]

For sellers, the message is straightforward: a large, exhibition-quality mobile is considered trophy material. These works can attract multiple bidders in the right sale environment. That said, pricing remains disciplined. Estimates that invite participation tend to outperform ambitious pricing that suppresses competition.

Tier 2: Unique paintings and works on paper

Calder’s gouaches, drawings, and occasional canvases form the backbone of the middle market. A strong gouache may trade in the $50,000–$100,000 range depending on scale, condition, and subject. Exceptional examples can reach into the low seven figures.

This segment is volume-sensitive. When markets strengthen, more owners consign works on paper, increasing supply. When supply rises faster than demand, pricing can soften.

The dataset referenced here illustrates that dynamic: median auction pricing for works on paper was roughly $85,000 in 2019–2020, slipped below $60,000 by 2023 amid elevated supply, and recovered to approximately $70,000 in 2024 as volume moderated.

Rather than reading this as volatility, it reflects absorption cycles. This tier functions as a practical barometer: when mid-market works clear steadily, confidence extends beyond trophy pieces. When they struggle, it often signals temporary oversupply rather than structural weakness.

Alexander Calder, Striped Crag, Filled Crag, 1972. Image: © Sotheby's

Barometer check

Calder’s gouaches are particularly revealing because they trade frequently and appeal to both emerging and seasoned collectors. Their pricing tends to move earlier than that of large sculptures.

After a supply-heavy 2023, median prices recovered into 2024–2025 as inventory thinned and institutional visibility increased.[2] While auction pricing is never driven by a single factor, renewed museum focus likely supported broader confidence.

For sellers, this indicates a stabilised mid-tier environment: not overheated, but structurally healthy. If you hold a quality gouache, today’s market appears more balanced than during the 2023 supply surge.

Tier 3: Prints and multiples

Calder’s prints and editions form the entry-level tier. Thousands trade publicly, typically in the low four-figure range, with high sell-through at appropriate pricing.

Price ceilings are constrained by availability. Condition, margins, signature clarity, and documentation materially affect results.

Timing is generally less critical than for unique works, but oversupply can weigh on pricing. When many similar prints appear simultaneously, buyers concentrate on the best examples. Staggered placement or specialist routing can prevent dilution.

Alexander Calder, Laughing Moon, 1974. Image: © Phillips

Tier 4: Design and jewellery

Calder’s artist-made jewellery occupies a niche but influential segment. Approximately 1,800 pieces were produced (per Calder Foundation records), and auction appearances are limited.

When they surface, results can be striking: a silver necklace achieved $1.9 million against a $400,000–$600,000 estimate in 2013.[7] Several 2020–2021 results significantly exceeded estimates, including a brass bracelet at $250,000 and a silver wire necklace at $612,000.[7]

Demand reflects cross-collecting between art and jewellery buyers. Supply is inherently limited. For sellers, channel selection matters: boutique auctions and private placements often reach the most committed buyers.

Signals from institutions and archives

Institutional visibility supports market confidence. Calder Gardens opened in Philadelphia in September 2025,[2] the Whitney staged “High Wire: Calder’s Circus at 100” in October 2025,[2] and the Fondation Louis Vuitton has announced a major 2026 retrospective.[2]

Such programming reinforces Calder’s canonical status and can influence buyer psychology. Increased visibility may tighten supply while encouraging new acquisition activity. However, anniversaries can also prompt increased consignments. Sellers should weigh both dynamics.

The Calder Foundation factor

The Calder Foundation maintains the archive and assigns inventory numbers to recognised works. While formal certificates are no longer issued in the traditional sense, inventory registration materially affects marketability.

In practice, major auction houses and serious private buyers expect Foundation registration. The Eight Black Leaves litigation underscored how the absence of an inventory number can impair saleability.[8]

For sellers, preparation is critical. Confirm registration, clarify provenance, and disclose condition history before bringing a work to market. Transparency protects value and prevents last-minute disruption.

Private sales and off-market strategy: controlling the outcome

A substantial portion of high-value Calder transactions occurs privately. Auctions provide public validation, but private sales offer control and discretion.

Private placement allows targeted outreach to known collectors and institutions. It reduces the binary risk of auction underperformance and enables negotiated pricing grounded in comparable data.

The 2014 private sale of Black Crescent (reported at approximately $10.6 million) illustrates how meaningful benchmarks can be achieved outside public auctions.[5]

For significant works — particularly mobiles, major gouaches, and jewellery — private sales can maximise control over timing, pricing, and buyer profile. Competition can still be cultivated discreetly through structured outreach.

Lower-value works (e.g., standard prints) are often more efficiently handled through auction or online platforms.

Alexander Calder, Earrings for Peggy Guggenheim, 1938. Image: ©Guggenheim

Sell now or wait? Making the decision

Timing depends on your work’s tier, condition, documentation, and your own objectives.

If selling now makes sense

- Recent results demonstrate competitive demand for strong examples.[1]

- Mid-market pricing has stabilised following prior supply pressure.

- Sculpture averages frequently land above estimates.[4]

- Institutional visibility is high.[2]

These conditions suggest supportive momentum. Selling into strength can reduce downside risk and enhance negotiating leverage.

If holding may be prudent

- You own a museum-level work that may benefit from carefully staged timing.

- Comparable works are currently saturating the market.

- Documentation or Foundation registration remains unresolved.[8]

- A forthcoming exhibition or publication may elevate your specific piece.

Waiting should be strategic rather than passive. Use the time to strengthen paperwork, monitor comparable sales, and quietly gauge interest.

The balanced approach

Whether you sell now or later, the objective is control. Monitor sell-through, mid-tier pricing, and institutional programming. Align your route — auction or private — with your work’s profile.

Avoid selling under pressure or without full preparation. Calder’s market is established and information-rich; disciplined sellers typically achieve disciplined outcomes.

The Artscapy advantage: from valuation to sale

Selling an Alexander Calder need not be opaque or stressful. Artscapy provides structured options:

Start with a 60-second estimate.

Receive an instant price range based on comparable public results. This offers a realistic starting framework.

Choose your route.

Fast Sale prioritises speed and certainty. Maximise Returns uses advisor-led strategy tailored to your work’s tier and condition.

Fast Sale (where eligible).

Non-binding purchase offers may be obtained within 1–3 working days, with 0% seller commission deducted.

Maximise Returns.

Structured private placement or curated auction strategy, with reserve protection and negotiation support.

Close securely.

Funds are secured via escrow before release, and logistics are coordinated professionally. The combination of data transparency, flexible routing, and fee clarity allows sellers to move forward with confidence.

Sources and references

[1] Katya Kazakina, Artnet News, May 2024. (Blue Moon sale result and commentary.)

[2] Maxwell Rabb, Artsy Editorial, December 16, 2025. (Calder Gardens; Whitney exhibition; Fondation Louis Vuitton retrospective.)

[3] Geoffrey Montes, ELLE Decor, October 17, 2025. (Painted Wood sale context and record background.)

[4] Marco Mahler, “Original Calder Mobiles For Sale,” blog, updated September 2025. (Annual sculpture volume and estimate performance data.)

[5] Marco Mahler, blog, updated 2014. (Private sale of Black Crescent.)

[6] Tess Thackara, The Art Newspaper, December 9, 2020. (Mariposa sale and international bidding.)

[7] Jill N. Newman, Town & Country, May 21, 2021. (Calder jewellery auction results.)

[8] Nick Divito, Courthouse News Service, March 6, 2014. (Eight Black Leaves litigation; Foundation registration implications.)