The Karpidas auction: How collectors can capitalise on September’s biggest sale

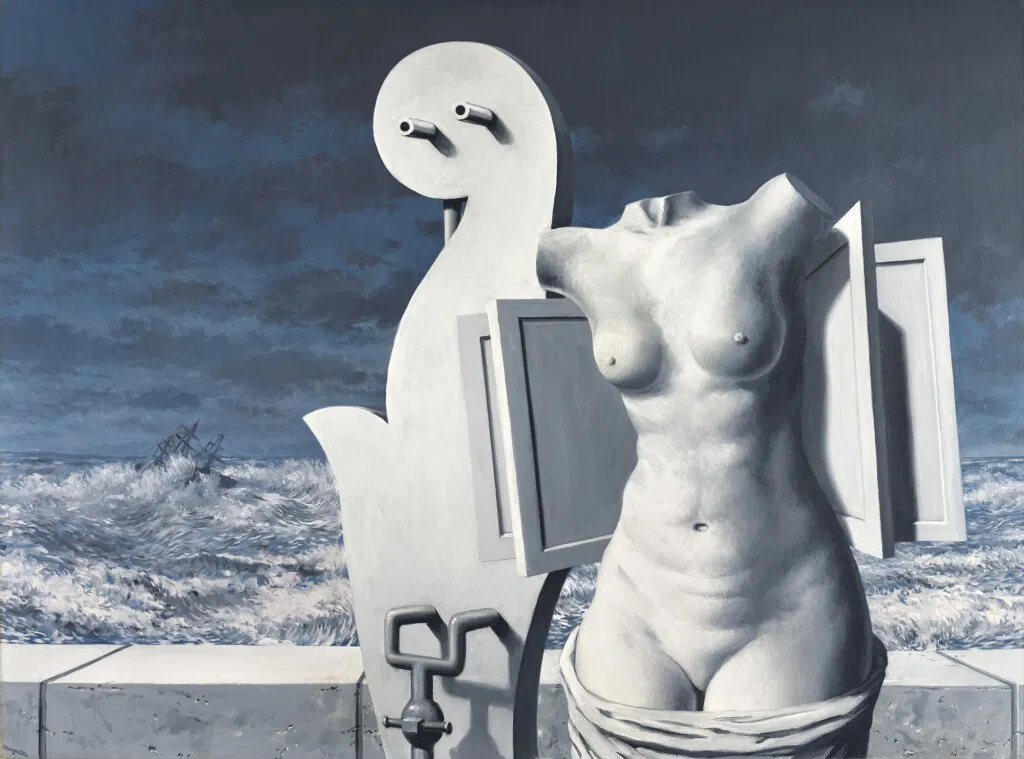

Pauline Karpidas brings The London Collection to Sotheby’s this September, a sale expected to set a new record as the auction house’s most expensive single-owner collection in Europe, with roughly 250 lots and a combined estimate exceeding £60 million. The evening sale is scheduled for the 17th of September 2025 in London, preceded by a public exhibition from the 8th to the 16th of September. Headliners include René Magritte’s La Statue volante (1958) estimated at £9 -12 million, alongside works by Leonora Carrington, Yves Tanguy and Max Ernst. These pieces have strong auction records and institutional demand, which matters for both bidding conviction and collateralisation after the hammer.

What changes the game for next-gen collectors is not only the optics of a blue-chip Surrealist moment, but the capital structure you can wrap around it, both before and after you raise your paddle. The immediate financing rails now embedded in the auction ecosystem, combined with lenders’ preference for high-quality, well-documented works, mean this sale isn’t just a buying event; it’s a balance-sheet event.

René Magritte’s La Statue volante (1958). Image: © Sotheby's

Angle 1: Smart acquisition finance - buy below estimate, then lever up

In single-owner, provenance-rich sales like Karpidas, below-estimate hammers are not a red flag so much as an instant equity buffer if the work’s broader comparables support a higher fair value. Post-sale, lenders typically advance ~40–60% of appraised value, and critically, the appraisal considers market comps and liquidity, not just the one data point of your purchase price. That appraisal-first approach is standard across specialist and legal guidance on art-secured lending.

If you want to monetise the position immediately, Sotheby’s Financial Services explicitly markets “immediate” financing at up to 50% of the hammer for qualifying purchases above $2 million, with a rapid turn from application to funding. In practice, that means the day you win a Magritte or Tanguy, especially if you’ve bought at or under the low estimate and you can recycle half the purchase price back into cash while retaining full upside in the asset. The house’s own lending arm grew aggressively in recent years, underscoring how mainstream this playbook has become.

The surplus value in a well-bought lot isn’t just bragging rights; it’s collateral quality. Surrealism’s benchmark names - Magritte, Ernst, Tanguy, Carrington, carry dense trade histories and museum visibility, which lenders prize because those traits compress time-to-valuation and lower idiosyncratic risk. That’s why the art-secured loan market has expanded to roughly $29 to $34 billion* outstanding and kept growing even as the broader art market cooled: lenders are comfortable advancing against works with transparent lineage and deep comparables.

Put simply: if you buy well in September, especially below estimate, you can finance well in September. The auction delivers the asset; the comp set delivers the appraisal; the loan returns liquidity without forcing a flip.

Angle 2: The big sale is coming - unlock liquidity now against your collection to win the Surrealist staple

If your goal is to own a cornerstone Surrealist from Karpidas but your liquidity is tied up in existing holdings, the pre-auction move is to borrow against what you already own. Advance rates of ~40–60% of appraised value are standard across banks and specialist lenders, with eligibility and margin improved by clean title, insurance, and market depth. That line can be arranged ahead of the view so you walk into the sale with a hard spend number and no need to sell into a thin market. This is exactly the use-case driving the category’s growth: in uncertain cycles, borrowers monetise art to fund time-sensitive acquisitions.

Timing matters. Sotheby’s has confirmed the evening sale on the 17th of September and the exhibition from the 8th of September, so the operational window is tight but realistic for lenders who know the playbook. Even if you prefer to finance through the auction house, they publicly state 30-day application-to-funding targets; with external lenders, pre-underwriting against your existing collection can be even faster if works are already in bonded storage and fully insured. The key is that the sale calendar is a liquidity calendar: lines in place before the rostrum give you bid discipline, and after the rostrum allow you to refinance a winning lot on more flexible terms once you control title. Through Artscapy Finance, collectors can pre-arrange credit lines against their holdings, giving them bid discipline before the sale and the flexibility to refinance acquisitions afterward - aligning capital with opportunity while avoiding forced sales.

Strategically, this is a barbell: collateralise a work you’re not ready to sell, and deploy that credit to capture a Karpidas-provenanced Surrealist with long-run institutional demand. Karpidas sale’s scale and curation - “the greatest collection of Surrealism to emerge in recent history,” provides exactly the depth of comps lenders and valuation firms want to see, which in turn supports stronger advance rates when you refinance your purchase post-sale.

The through-line is simple: use September’s visibility to your advantage. Whether you originate credit after buying a lot below estimate or pull liquidity before the bidding, today’s art-finance infrastructure, enhanced by platforms like Artscapy, lets you align capital with opportunity without becoming a forced seller. That is the edge for next-gen collectors in this market: treat the sale not just as a catalogue, but as a liquidity event you can orchestrate.

*Art & Finance Report, 2024