Lucio Fontana market analysis. Is now a good moment to sell? (February 2026)

Last updated: 04/02/2026. Reading time: 12 minutes.

Owning a Lucio Fontana artwork means navigating a market defined by iconoclasm and selectivity. Some Fontana pieces, the slashed canvases and the oval “cosmic egg” paintings, have become trophy works that can command millions, while others like prints, sketches, and minor ceramics, may trade for a few thousand. As a collector, you face a familiar dilemma: take advantage of a headline-grabbing market now, or wait for a more favourable window?

The data points to a disciplined market: it consistently rewards Fontana’s most recognisable concepts and is far less forgiving elsewhere. Verdict: if your Fontana embodies the Spatialist language buyers actively seek, today’s market can offer real liquidity — with realistic pricing and careful positioning.

Data note: All figures reflect public auction results from 2018 through January 2026 (in USD, including buyer’s premium where reported). This dataset updates daily, so benchmarks may shift as new sales occur. Private sales are not included, even though they increasingly influence high-end outcomes.

👉 Click here and get a price range in about 60 seconds.

In this article

- Case study – a cosmic benchmark: How one record-setting Concetto spaziale sale redefined expectations for Fontana’s market.

- What drives Fontana’s market: Why a slashed canvas can fetch 1000× the price of a print — and which series act as market barometers.

- Private sales for a Spatialist: How savvy sellers quietly place Fontana works off-market to control pricing, provenance, and risk.

- Sell now vs. wait: A decision framework grounded in Fontana’s market tiers, recent trends, and the logistics of authenticity.

- Next steps with Artscapy: How to get a data-backed valuation in 60 seconds and explore sale options with zero seller fees.

Case study: The $23 million question

In May 2024, a large Concetto spaziale, La fine di Dio — one of Fontana’s coveted oval “cosmic egg” canvases from 1964 — came up for auction after a decade-long gap since a top example was last seen publicly[1]. Expectations were high. With an estimate of $20–30 million[2], it was positioned as a potential new benchmark for Fontana at auction. Collectors took notice: the painting combined colour impact with exhibition pedigree and came from a prominent Dallas collection associated with quality[3][1].

When the hammer fell, the work sold for $22.96 million in New York[4]. While it did not surpass the artist’s 2015 auction record ($29.2 million for another La fine di Dio example[5]), it still ranked among the top ten lots of the spring season[6]. More importantly, it demonstrated that Fontana’s market could absorb a major work even amid a cautious climate. Bidders moved above the $20 million low estimate to compete[7], underscoring persistent demand for Fontana’s most iconic material. Inference: for sellers holding top-tier Fontana (the kind of work that comfortably sits in museum-led narratives), the 2024–25 market showed that deep-pocketed buyers remain present — but selective. The winning bid landed in the lower half of the estimate range[8], suggesting discipline rather than exuberance. Practically: a Fontana consignment today is likely to clear the market if it is properly authenticated, marketed, and priced in line with the most relevant comparables — not an assumed record trajectory.

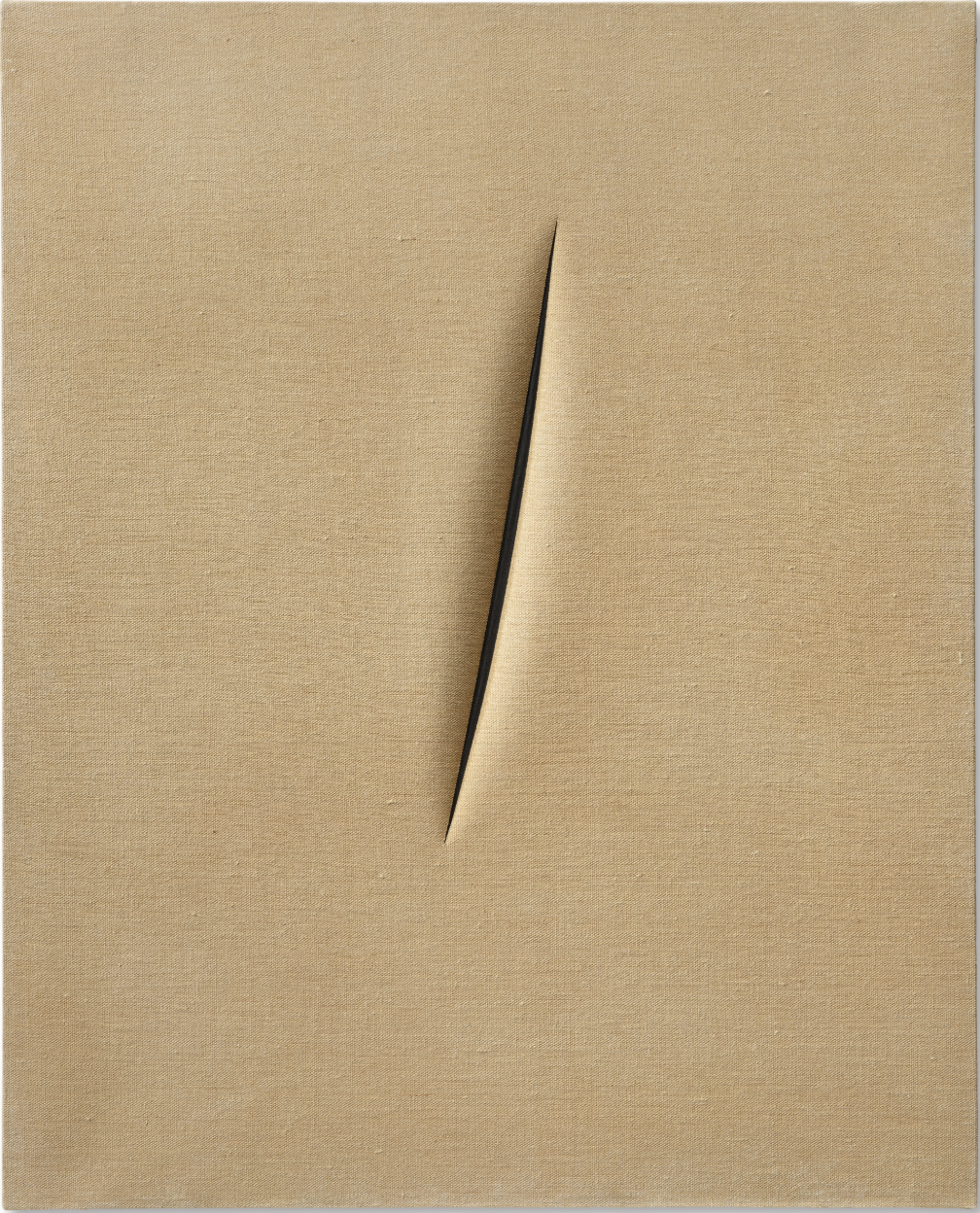

Lucio Fontana, Concetto spaziale, 1960. Image: © Sothebys

The significance of this result went beyond the number. Every auction season has a handful of “barometer” lots that signal broader sentiment. In 2024, the yellow La fine di Dio was one of them. Its solid (if not sensational) outcome suggested confidence in blue-chip post-war European art, even as parts of the contemporary market softened. It also highlights a key timing factor: this was the first yellow Fine di Dio to appear publicly since 2015[1]. Scarcity matters in Fontana’s market, and collectors had waited nearly a decade for another opportunity.

A year later, in mid-2025, another Fine di Dio — an oil and glitter canvas — came to market in a more saturated environment and sold for a softer $14.5 million[9]. The contrast is instructive: two related “cosmic eggs,” two very different outcomes. Conclusion: in Fontana’s market, context is not a footnote — it’s a pricing driver. When an appearance feels like a rare event, buyers respond. When supply looks less controlled (for example, two major works arriving close together), pricing can retrace. For sellers, it’s essential to benchmark against the most recent truly comparable sale — and to assess how “unique” your work’s timing and characteristics read in the current landscape.

What drives Fontana’s market?

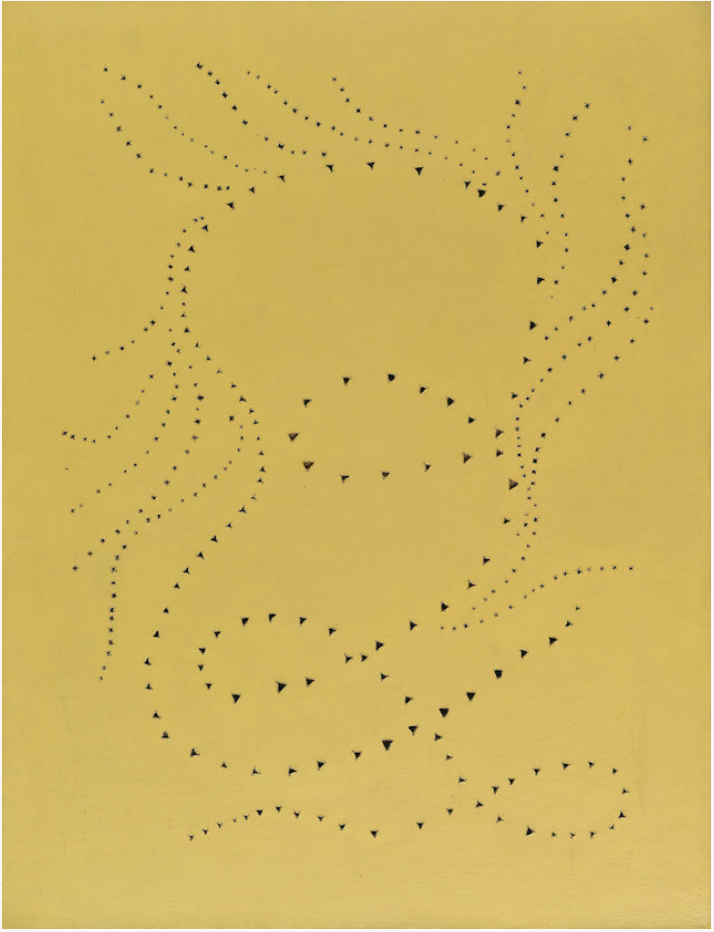

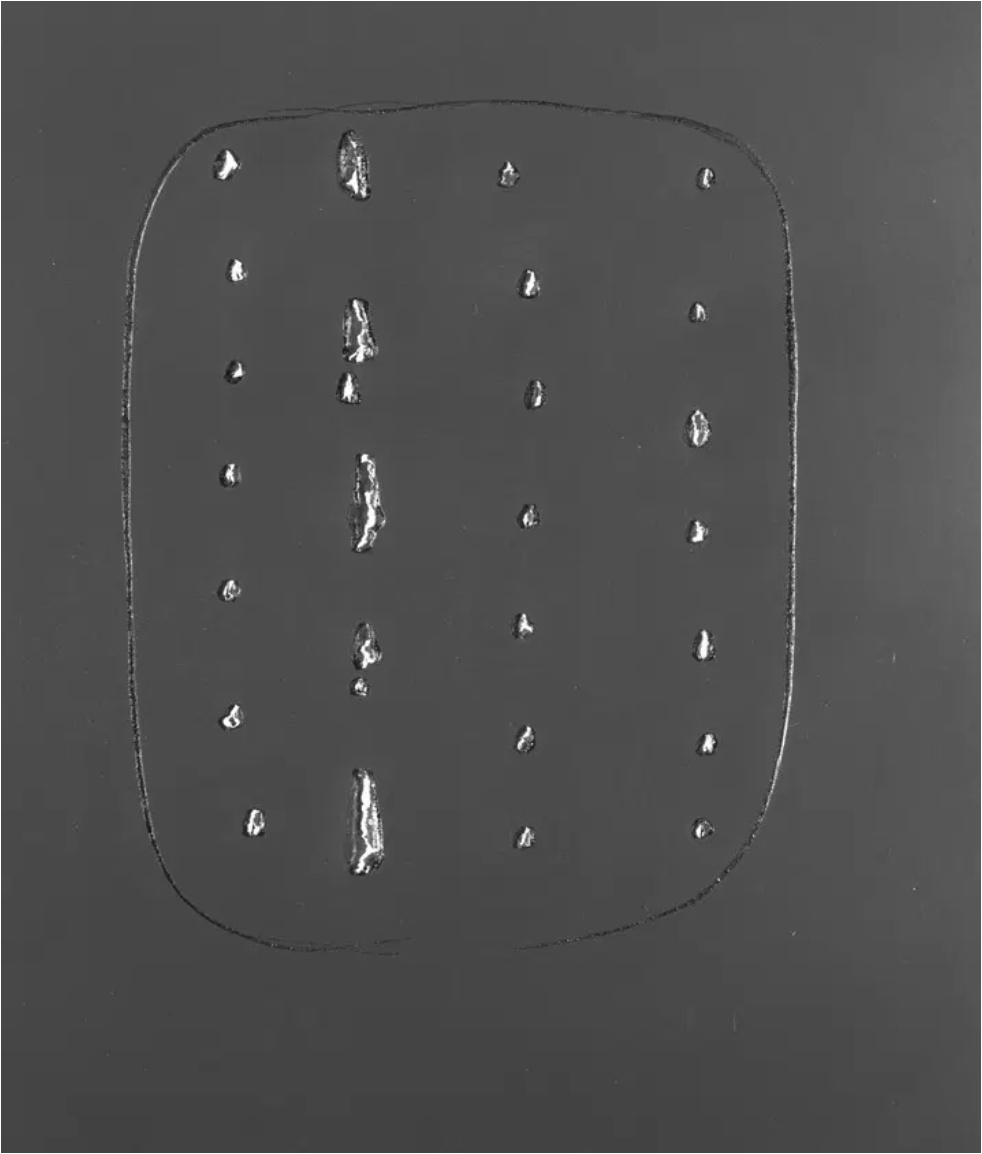

Fontana’s market is hierarchical, with a sharp divide between works that epitomise Spatialism and those that sit outside it. At the top are masterpieces from the late 1950s to mid-1960s: the slashed monochrome canvases (Tagli, or “cuts”), the perforated “Spatial Concepts” (Buchi, or holes), the punctured La Fine di Dio ovoids, and select series such as the glass-flecked Venice paintings. These are the works that appear in major retrospectives and art-historical narratives — and they dominate the high end accordingly. Every one of Fontana’s ten highest auction prices on record comes from this post-war period and these signature series[10]. Collectors particularly prize the 38 oval Fine di Dio canvases from 1963–64 and the drama of large red Attese (slash paintings)[10][11]. These are widely treated as the purest expressions of Fontana’s Spatialist vision and regularly achieve seven- and eight-figure results at auction[12].

By contrast, works on paper, prints, ceramics, and early figurative or abstract works trade in a different arena. Auction data since 2018 shows a wide spread: the overall median price for Fontana at auction was around $55,000, but that single figure obscures two almost separate markets. Paintings (often slashed or holed canvases) had a median hammer around $420,000 in this period, whereas prints and other multiples sat around a median of only ~$5,000 — effectively an entry level[13]. Individual Fontana prints often fetch roughly £3,000–£15,000, unless part of a sought-after series where a complete set can reach the low five figures[13]. The gap (paintings worth roughly 100× prints) reflects a basic buyer reality: the market pays for spatial impact and scarcity. A slashed canvas is a one-off, art-historically legible object — Fontana’s physical gesture is the work — whereas a multiple, while collectible, usually does not carry the same scarcity or presence.

Supply is also worth understanding. Fontana was prolific in his exploration of cuts: between 1949 and 1968, he produced at least 1,512 slashed canvases (Concetto spaziale, Attese) according to the official archive[14], each differentiated by scale, colour, cut configuration, and the handwritten inscription on the reverse. That is a substantial number, but demand is global — and not all Tagli are equal. A large, vivid red canvas with multiple clean vertical slashes typically has a very different buyer set (and pricing power) than a small format with a single cut or a less compelling colour. The market has built a clear internal hierarchy: for slashes, collectors weigh size, colour, number and arrangement of cuts, and condition (particularly the canvas and paint integrity around the cuts). Similar hierarchies apply to Buchi (complexity and placement of perforations, and the desirability of the ground) and to sculpture (Fontana’s Nature/Natura orbs generally outprice modest glazed ceramics). In practical terms, Fontana’s oeuvre contains a small number of truly blue-chip categories and many secondary categories — and the spread between them is material.

At the top end, Fontana’s market has shown resilience. Even when the broader market corrects, his best works have tended to hold value. After a peak in 2015–2017, many post-war Italian names softened, but Fontana largely resisted that pattern[15]. A Christie’s specialist pointed to the role of major exhibitions — including the 2014 Paris retrospective and the 2019 Met Breuer show in New York — in broadening international collector attention[16]. Since 2015, nine of Fontana’s ten highest auction prices have been achieved, which supports the view that confidence in the best material has persisted[17].

Lucio Fontana, Concetto spaziale, Attesa, 1951. Image: © Guggenheim

That confidence is also geographically diverse. While Italy and Europe were historically central to Fontana’s market, American, Asian, and Middle Eastern buyers are now highly active[18]. For sellers, that matters: the buyer pool for prime Fontana is global, and liquidity exists — for the right works, with the right documentation. In our analysis of Fontana lots since 2018, the overall sell-through rate is about 86% (excluding withdrawn lots), and the “golden period” works perform even more strongly. In late 2023, a pristine white La Fine di Dio offered in New York sold within estimate for $20.6 million[19], during a season when other high-ticket segments were struggling. Dealers have also remarked that Fontana’s slashed canvases were among the few top-dollar works that continued to transact cleanly through uncertain periods[20]. Luigi Mazzoleni observed that during the early 2020 pandemic freeze, “the only works [we] could sell online were Fontana’s slash paintings — they are iconic”[21].

So what does this mean if you’re considering a sale? Start by identifying where your work sits in the hierarchy. If you own a marquee piece (for example, a 1960s canvas with cuts or an important sculpture), current evidence points to disciplined but real demand. These works often trade like blue-chip assets: in 2025, a double-slashed red canvas of moderate size might bring around €2 million at auction (assuming proper authentication)[22], while exceptional examples can go significantly higher. If your work is a print or a smaller multiple, the market can still be active, but it is more price-sensitive and driven by collector taste rather than momentum. In that range, condition and provenance can move the number meaningfully — but rarely shift the work into a new tier.

Finally, watch Fontana’s internal “barometers.” The most useful signal is performance of slashed canvases at auction: they appear frequently enough that their sell-through and pricing reflect sentiment. Are good Tagli selling above estimate, or leaning on reserves? In recent years, they have generally sold steadily, often meeting expectations — a stable baseline. A season where multiple good Tagli fail to sell would be a meaningful warning sign. As of now, that pattern has not emerged: even middle-tier slashes have found buyers when priced correctly, and the best examples still generate competition. Fontana’s market runs on iconography and selectivity: the icons (slashes, holes, eggs) pull the strongest bids, and sellers who understand the work’s position in that hierarchy can route it to the right buyers at the right price.

Private sales for a Spatialist

Even though Fontana’s art is about opening the void, the act of selling often happens behind closed doors. A meaningful share of Fontana transactions — especially at the top — now occurs via private sales rather than public auction. In 2024, major auction houses reported surging private sale volumes even as auction totals dipped[23][7]. This shift is not unique to Fontana, but it is particularly relevant to his market. Here’s why:

Selective supply and discretion. Owners of top-tier Fontana works often prefer a discreet sale to a known buyer rather than an auction spectacle. A Fine di Dio at $20 million has a narrow buyer set: there may be only a handful of collectors (or institutions) with both the appetite and capacity. Private sales allow sellers (via an agent or an auction house private sales team) to approach those buyers quietly, gauge seriousness, and negotiate without the pressure of an auction clock. This can also be helpful when the work has complexities — condition questions, or a “between-tier” example that may not trigger a bidding war. A private placement reduces the risk of a public failure, which can become part of the market record and weigh on perception[24][25]. For Fontana, where the very top is expensive but not always as liquid as the most heavily traded American blue-chip names, that control often has practical value.

Price control in a nuanced market. Fontana auction results can vary with timing and context. Private sales enable confidential price discovery. A seller can set a range informed by public comparables (often with a premium for discretion and immediacy) and see whether a buyer engages. In uncertain periods, many consignors test private routes first. It’s notable that in 2024, as the public market cooled, Christie’s private sales rose 41% to their highest level since 2020[23]. Auction houses actively court Fontana owners because the right private buyer may pay strongly for an iconic slash without the public volatility of a sale room. Inference: if you have a strong Fontana but worry that an upcoming auction season may not suit it, private placement can be a lower-risk way to seek a robust net result.

Lucio Fontana, Natura I, 1961 © buffaloakg

Authentication and control of narrative. With Fontana, authenticity is central. The Fondazione Lucio Fontana in Milan is the key gatekeeper, and a work not in the archive or lacking appropriate certification will struggle to attract serious market interest[22]. Auction houses typically require the Fondazione’s certificate for significant Fontana works — as one German family learned when Sotheby’s required a certificate before accepting a slashed canvas for consignment[22]. The foundation’s review can take months and is handled periodically by a committee of experts[26][27]. If you are planning to sell, you should assume this step is essential. Private sales can sometimes offer more flexibility in sequencing: discussions may begin contingent on forthcoming certification, and a transaction can be structured around that timeline. A private channel can also keep any attribution uncertainty out of public view. In the rare event the Fondazione declines certification, the absence of a public auction headline can be materially beneficial, given past legal disputes involving Fontana attributions[28][22]. In short: private sales can offer more control over process and optics.

Targeted placement and long-term value. Many Fontana owners think in legacy terms: these are foundational post-war works. Private sales may allow sellers more say in who buys, and in some cases, whether the work goes to an institution or a long-term collection rather than to a short-term trader. This is not purely emotional; it can affect future value. A Fontana placed into a respected collection and shown occasionally may re-emerge later with strengthened provenance, whereas a work that appears repeatedly at auction in a short span can start to feel “over-traded.” Private dealing can therefore be part of a strategic placement that supports a work’s longer-term market standing.

A note on fees. The old assumption that auction equals the best price and private sale means compromise is less reliable than it once was. Auction houses have trimmed public sale calendars and expanded private brokering, sometimes offering 0% seller’s commission privately (while charging the buyer and/or earning a margin). Depending on terms, the seller’s net outcome can be comparable — and sometimes better — than auction, especially when you factor in risk, reserve strategy, and marketing costs. For example, Artscapy charges 0% to the seller for private placements, meaning you retain more of the agreed price.

Bottom line: Fontana’s market has a public face (auction records) and a private backbone that frequently determines real outcomes. For high-value works — or any piece with nuance around condition, attribution, or timing — private sale channels can offer control, confidentiality, and a more managed path to a strong result. Next, we’ll consider whether now is the moment to make that move, or whether waiting may be wiser.

Sell now or wait? A two-path framework

Every collector eventually asks: “Should I sell now, or hold my Fontana longer?” There is no universal answer — it depends on your specific work and your circumstances. But based on the evidence, there are two clear paths: one where selling in the current market is advantageous, and one where waiting can be rational. Let’s examine each.

Selling now: Riding the stable demand

You may lean toward selling now if your Fontana sits in a liquid segment of demand and if current conditions support a clean transaction.

Your work is in the “sweet spot.” If you own a classic slashed canvas (particularly late 1950s or early 1960s, with desirable scale/colour and multiple cuts) or a high-calibre perforated painting, the data suggests these works continue to trade well. Recent seasons have shown robust sell-through for Fontana’s benchmark material; in curated Italian art sales and evening sales, such works are often fully placed, with competitive bidding for the best examples. For instance, in the May 2025 New York auctions, Concetto spaziale, La fine di Dio sold within estimate at $14.5 million[9], despite generally cautious bidding conditions. Specialists also noted that great works “priced correctly” still performed[29]. If your Fontana falls into that category — even at a solid mid-six-figure level — selling into a market that continues to reward quality can make sense. Buyer appetite appears intact, but it is conditional on credible pricing and strong presentation.

Lucio Fontana, Concetto Spaziale, Ovale, 1968 © Artists Rights Society (ARS)

Market conditions suit Fontana’s segment. The broader market has cooled from the 2021 peak, but the cooling has been uneven. The very top end (works above $10 million) pulled back in 2025[30], while the middle market (works in the six- to low seven-figure range, where many Fontanas sit) has been more resilient[31]. Auction sell-through reached roughly 84% in 2024 — the highest in years[31] — which points to a disciplined but functioning market. Fontana’s core pricing band is often supported by committed collectors rather than short-term speculation[32]. Inflation and interest rates may have made some participants more cautious, but blue-chip collectors with long-term views have continued to engage with canonical names. Inference: this is a buyer-led market — not exuberant, but willing to pay properly for the right work. For sellers, that can be favourable: fewer surprises, fewer unrealistic expectations, and a greater likelihood of a reliable close.

No obvious catalyst for waiting. Unless there is a specific event likely to reframe demand (a major retrospective, a significant publication, a new catalogue raisonné development), Fontana’s market tends to move in increments rather than spikes. As written, there is no identified blockbuster on the near horizon that would obviously change demand in the next 12 months. In that context, waiting may not offer a clear pricing advantage — especially if more works re-enter the market and create competition. The auction pipeline from 2023–25 brought notable supply; 2026 currently looks relatively open. Selling now can allow you to avoid competing against a similar work that appears near your sale window.

Financial and logistical readiness. If your documentation is in order — particularly the Fondazione certificate — and if liquidity now is useful, the case for selling strengthens. Markets are cyclical; while there is no clear signal of a Fontana-specific downturn, broader shifts can affect luxury demand. If you can achieve a strong, defensible price today, it may be reasonable to prioritise certainty over hoping for marginal upside later. Many seasoned collectors are adjusting holdings in exactly this way: reducing exposure while pricing remains firm.

Seller’s advantage: Selling now means engaging a market that still respects Fontana’s status, but rewards precision: proper authentication, credible comparables, and a channel that suits the work. Our recommendation: if your Fontana is high-demand and authenticated, consider a sale within the next 3–12 months. Create competitive tension — whether via a well-timed auction (for example, an Italian Art sale in London or an evening sale in New York) or via a private process where multiple qualified collectors are approached discreetly. Anchor expectations to the most relevant 2022–2025 comparables. As one dealer put it after a recent Sotheby’s result, “works of great quality withstand the more difficult times”[29] — that is the scenario you are aiming to leverage.

Waiting: When holding makes sense

There are also situations where waiting is not hesitation but strategy — either to let conditions improve for your specific category or to complete necessary groundwork.

Your work isn’t in peak demand (right now). If your Fontana sits in a more niche category — for example, a ceramic Concetto spaziale from the early 1950s, or an atypical mid-1960s canvas — it may not align with what auctions are currently prioritising. In those cases, waiting can allow taste and scholarship to catch up. Market preferences can evolve: the Fine di Dio were relatively underappreciated compared with slashes a decade ago, and sustained scholarship plus strong results helped re-rate them. It is plausible that other categories may gain profile through institutional focus over time. If your work is off the beaten path, watch for museum programming or scholarship that might lift interest in that medium or period. (If you are relying on a forthcoming exhibition or publication, treat it as a potential tailwind rather than a guarantee.)

Recent comparables suggest a cooldown. Timing matters. If a closely comparable work has just underperformed — sold below expectation, barely met reserve, or failed to sell — the market will anchor to that result. The earlier contrast between $22.96M and $14.5M for Fine di Dio examples a year apart illustrates how sensitive pricing can be to supply and context[4][9]. If there has been a cluster of Fontana lots in recent seasons and prices looked soft, waiting can allow scarcity — and urgency — to rebuild. If you are targeting a top outcome, you may benefit from letting the calendar reset and watching whether the next season’s results firm.

You need to resolve documentation or improve the work’s profile. For Fontana, this is decisive. If you do not yet have the Fondazione certificate, the priority is to begin that process — and in most cases, selling before certification materially reduces your options and pricing power[26][27][22]. Without it, major auction houses may refuse the consignment and buyers may discount heavily or walk away entirely[22]. Beyond certification, consider whether the work could be published, exhibited, or supported by additional provenance research. For major pieces, strengthening the documentary “file” can be value-additive: resolving gaps, adding credible exhibition history, or securing publication can affect buyer confidence. Even for mid-tier works, clearer provenance and condition reporting can expand the buyer pool and reduce friction.

Market outlook and personal timing. Macro confidence influences high-end art. If broader conditions improve — for example, if capital rotates back toward blue-chip assets — Fontana would likely benefit given his canonical status. But personal timing matters too. If you don’t need to sell, there is nothing irrational about holding a work you value, especially if selling would feel premature. The risk in waiting is that broader conditions could worsen or that competing supply could emerge at an inconvenient time. However, given Fontana’s track record, a well-maintained, properly authenticated top piece is unlikely to experience severe value erosion absent a major global shock; the more common scenario is slower appreciation or a period of consolidation.

In summary: wait if your work is not ideally positioned right now, if comparables are signalling softness, or if you have essential work to do (authentication, research, the right channel). Fontana’s market has a long-term upward trajectory with periods of consolidation. The goal is to sell into a receptive, informed market — not a moment of indifference or oversupply.

Lucio Fontana, Concetto Spaziale A, 1968 © Brooklyn Museum

The Artscapy advantage: next steps

Whether you choose to sell now or later, preparation and reliable benchmarks matter. At Artscapy, our role is to help you make a clear-eyed decision and execute it on terms that suit your work and priorities. Here’s how the process works:

Start with a 60-second estimate. Begin with a free, instant price range for your Lucio Fontana. Enter key details — medium, size, year, condition, provenance highlights — and our data engine compares your work to hundreds of auction results (refreshed every 24 hours) to provide an evidence-based valuation range. It’s fast, private, and obligation-free. This is a starting point rather than a final appraisal, but it gives you an initial benchmark grounded in market evidence. Get a price range in about 60 seconds.

Pick your path. With a valuation range in hand, you can choose how to proceed. Artscapy offers two primary routes: Fast Sale or Maximise Returns. Fast Sale prioritises speed and certainty. Maximise Returns is an advisor-led strategy aimed at achieving the strongest possible outcome over a longer timeline. In either case, you remain in control. We’ll review the specifics of your Fontana — relevant comparables, uniqueness, demand, and practical constraints — and recommend the right approach: targeted private placement to a shortlist of Fontana collectors, an auction consignment under negotiated terms, or a hybrid strategy (including third-party guarantee structures where suitable). If it’s a fit, you can request purchase offers within 48 hours with a 0% seller fee.

Fast Sale – get offers in 1–3 working days (where eligible). If speed is the priority and your work qualifies (generally pieces with strong liquidity), our Fast Sale channel can secure a non-binding purchase offer typically within 48 hours. We approach pre-vetted buyers with active mandates for artists like Fontana. Because we charge 0% commission to the seller, offers are not reduced by seller fees. You can accept if the offer meets your expectations or decline with no obligation. If you proceed, we handle logistics: viewing or condition checks, secure packing, and transport.

Maximise Returns is our bespoke sale strategy service. Some Fontanas benefit from careful timing and channel selection — for instance, a curated sale during a key London or New York week, or a discreet private placement. We lay out the rationale (auction, private, or hybrid) based on what the work is, how it compares, what is coming to market nearby, and your goals.

Close cleanly and confidently. Once terms are agreed, Artscapy manages a transparent, seller-friendly close. We handle escrow of the artwork and funds so payment is secure. For Fast Sales, payment is initiated the same day the work arrives in our care. For other transactions, payout is within 7 days of closing. And our seller commission is 0%. Any standard costs (shipping, insurance, and related logistics) are outlined upfront, and we support the paperwork required for a compliant transfer — including export licensing where applicable and confirmation of the work’s registration status with the Fondazione to preserve provenance continuity.

Selling a Lucio Fontana is a significant decision — financially and historically. Our aim is to ensure that if and when you sell, you do so with accurate benchmarks, the right strategy, and a process that is smooth and secure.

Sources and references

Emma Crichton-Miller, “The white-hot work of the Italian Spatialists,” Apollo Magazine, Apr. 12, 2024. Accessed 04 Feb 2026. [5][19]

Annie Armstrong, “Paint Drippings: Everything You Missed in the Art Industry Last Week,” Artnet News, Apr. 8, 2024. Accessed 04 Feb 2026. [1][33]

Eileen Kinsella, “Here Are the 10 Most Expensive Lots Sold at Auction in May 2024,” Artnet News, Jul. 18, 2024. Accessed 04 Feb 2026. [4]

MyArtBroker, “Lucio Fontana Value: Top Prices Paid at Auction,” updated Jan. 9, 2026. Accessed 04 Feb 2026. [10][12]

MyArtBroker, “A Seller’s Guide to Lucio Fontana (Prints),” updated Jan. 9, 2026. Accessed 04 Feb 2026. [13]

Coline Milliard, “Major Unidentified Lucio Fontana Painting Authenticated After Decade of Research,” Artnet News, Mar. 9, 2014. Accessed 04 Feb 2026. [22]

Artnet News, “Basquiat Tops Sotheby’s $186.1 Million Contemporary Art Triple Header,” May 17, 2025. Accessed 04 Feb 2026. [9][29]

Maddox Gallery, “Behind Closed Doors: The Shift from Public Auctions to Private Art Sales in the Global Art Market,” Apr. 28, 2025. Accessed 04 Feb 2026. [24][23]

Die Zeit, “Lucio Fontana: The Riddle of Milan” by Johannes Nichelmann (English edition), Sept. 15, 2021. Accessed 04 Feb 2026. [14][22]

Bank of America Private Bank, “Fall 2025 Art Market Update: Analyzing Current Trends,” Oct. 2025. Accessed 04 Feb 2026. [30][34]

[1] [2] [33] Paint Drippings: Everything You Missed in the Art Industry Last Week

[3] [10] [12] [17] Lucio Fontana Value: Top Prices Paid at Auction | MyArtBroker

[4] [6] [8] Here Are the 10 Most Expensive Lots Sold at Auction in May 2024

[5] [11] [15] [16] [18] [19] [20] [21] The white-hot work of the Italian Spatialists - Apollo Magazine

[7] [23] [24] [25] [31] [32] Behind Closed Doors: The Shift from Public Auctions to Private Art Sales in the Global Art Market | Maddox Gallery

[9] [29] Basquiat Tops Sotheby’s $186.1 Million Contemporary Art Triple Header

[13] A Seller’s Guide to Lucio Fontana | MyArtBroker | Article

[14] [22] [28] Lucio Fontana: The Riddle of Milan | DIE ZEIT

[26] [27] AUTHENTICATION OF WORKS – Fondazione Lucio Fontana

[30] [34] Fall 2025 Art Market Update: Analyzing Current Trends