Salvo market analysis. Is now a good moment to sell? (January 2026)

Last updated: 20 January 2026. Reading time: 9–13 minutes.

Owning a Salvo can feel like holding two things at once. A very legible painting market, and a very unforgiving one. The names look familiar. Il Mattino, Primavera, La Valle, Una sera. The venues look reassuring. Christie’s, Sotheby’s, Phillips. Then you notice how fast the “easy” price range moves, how public a pass can be, and how much of the outcome is decided by one unsexy variable. Paperwork.

If you want validation, auction can give it. If you want control, you need a plan. The best move is the one that fits what your Salvo actually is.

👉 Click here and get a price range in about 60 seconds.

Data note. The figures below reflect public auction results in this data set from 10 December 2020 to 3 December 2025. Prices are reported as hammer prices, converted to US dollars for comparison, and they do not capture private sales, dealer placements, or confidential transactions. As new sales occur, benchmarks can shift.

In this article

- The auction tape. Liquidity, selectivity, and what buyers actually pay

- Case study. Il Mattino and why the ceiling moved

- How the Salvo market works. A hierarchy of formats, and one reliable barometer

- What buyers reward. Titles, light, scale, and where “passed” lots tend to sit

- Private sale for Salvo. Why control is structurally rational here

- Sell now vs wait. A calm decision framework

- Sell with Artscapy. Valuation first, then optional offers

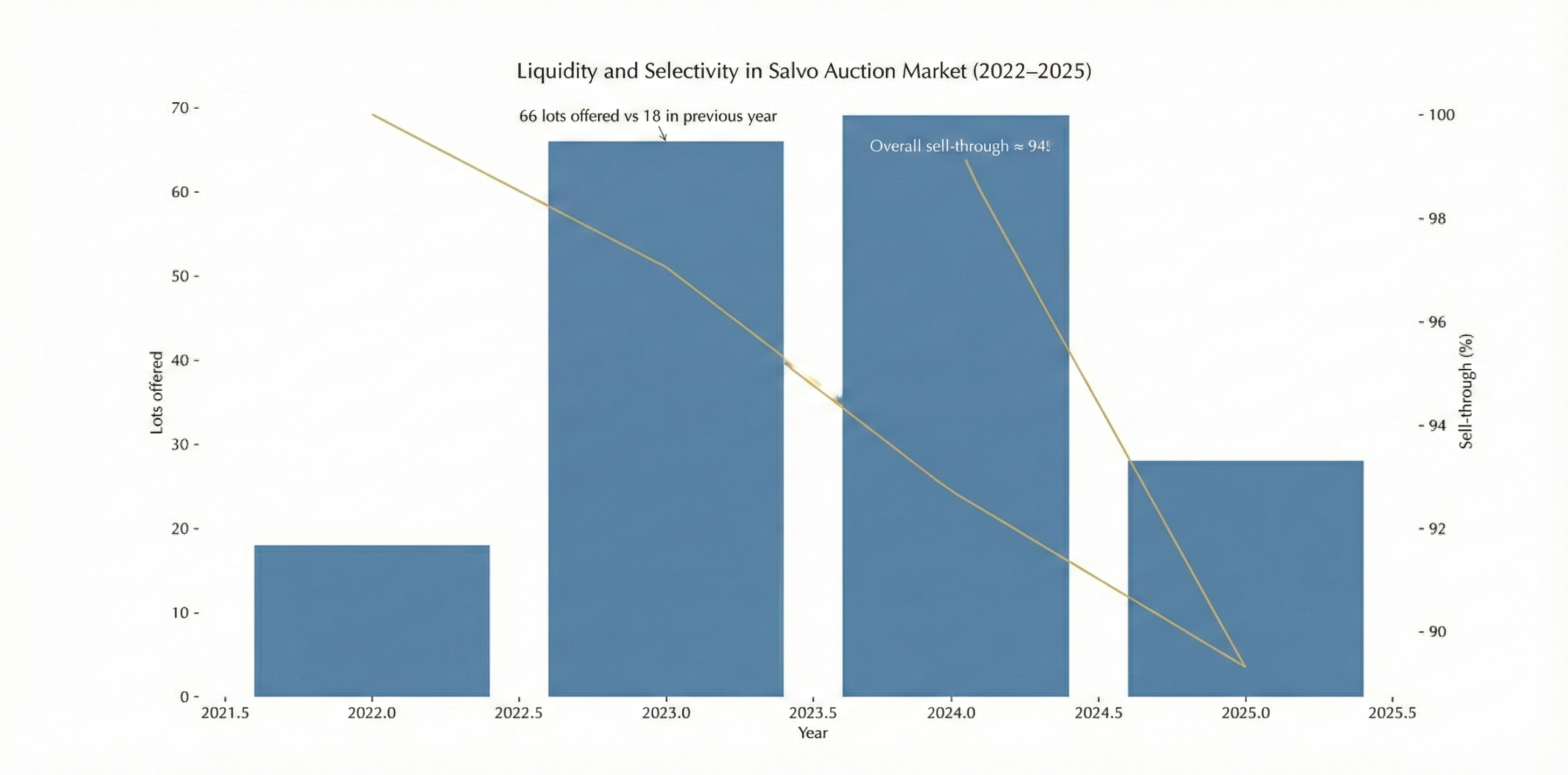

The auction tape. Liquid market, wide spread

This is a market that looks straightforward until you try to sell it. Salvo’s paintings are readable and repeatable. Buyers recognise the “product” fast. But the same recognisable product produces very different outcomes depending on format tier, title, and how confidently the work can be authenticated through the Archivio.

Across this public auction tape, sell-through sits around 94% (excluding withdrawals). That is strong liquidity for a contemporary Italian market that has recently globalised through London, Hong Kong, Milan, and New York. The implication is simple. If your painting fits the chased part of Salvo’s output, there are bidders. If it does not, the market still exists. It just gets picky in public.

In the most recent year of sales in this data, the median hammer price is about US$52k. That median is useful because it describes where “ordinary success” lives for Salvo right now. It is also a warning. Anything that needs heroic bidding to get over the line should usually avoid a public runway.

The middle half of recent results spans roughly US$16k to US$96k. That spread is the real story. Salvo is one of those artists where you do not “own a Salvo”. You own a specific object that sits somewhere in a market hierarchy. Your first job is to place it correctly. Your second job is to choose a channel that does not force the wrong benchmark onto it.

Case study. Il Mattino and why the ceiling moved

Salvo’s ceiling is created by a specific kind of picture, in a specific kind of room, for a specific kind of buyer. The cleanest illustration is the auction record. In Hong Kong, Christie’s sold Salvo’s Il Mattino (The Morning) for around US$1.1m at the hammer.

Salvo, Il Mattino (The Morning), 1994. Image: © Archivio Salvo

That moment mattered because it changed behaviour. It did not just crown one painting. It told bidders that Salvo’s best large canvases can function as trophies in a global evening-sale context, not as regional curiosities. It also changed seller psychology. Once a ceiling prints, more owners consider selling. More supply tests the market. Selectivity increases.

Inference: after a ceiling-setting moment like Il Mattino, the market stops behaving like a discovery phase and starts behaving like a sorting phase. Strong works keep trading. Average works get exposed.

How the Salvo market actually works

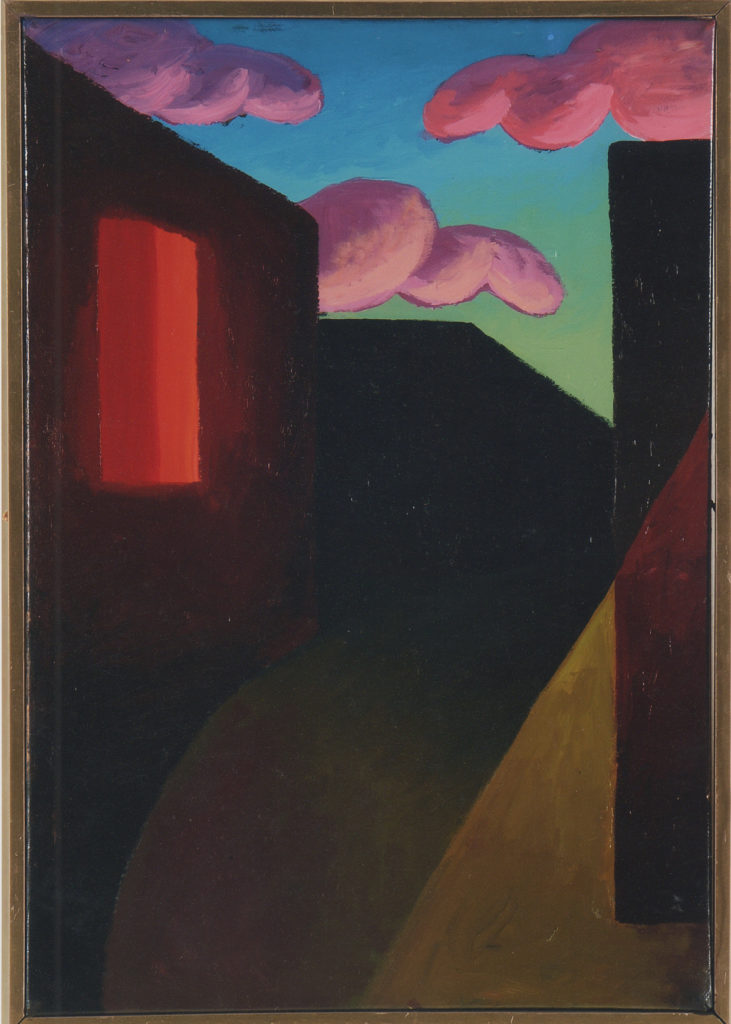

Salvo’s market is not organised by “early” and “late” in the way many postwar artists are. It is organised by how convincingly the painting delivers Salvo’s signature mechanism. Light, time, and place. That mechanism shows up in the titles and the imagery. Primavera, Maggio, Ottobre, Una sera, Notte d’inverno. Even when the title is Senza titolo, the best paintings still feel like a specific hour. Critics have repeatedly noted how his small-to-medium oils use titles and lighting conditions to signal time of day, months, and seasons. That is not decoration. It is the product buyers buy. [2]

Salvo, Una Sera, 1999. Image: © Archivio Salvo

This is also why institutions and programmes matter unusually much for Salvo. His practice moved from conceptual strategies and Arte Povera adjacency into a sustained return to painting, which museums and curators have framed as central to understanding him. MACRO’s Autoritratto come Salvo explicitly addresses that shift and positions his post-1973 painting phase as a major arc, not a side note. [7] MASI Lugano’s Boetti/Salvo exhibition frames him inside a Turin context that serious buyers pay attention to. [8] Gladstone has kept building a programme around him, including exhibitions that centre travel, memory, and imagined landscapes, in collaboration with Archivio Salvo. [4]

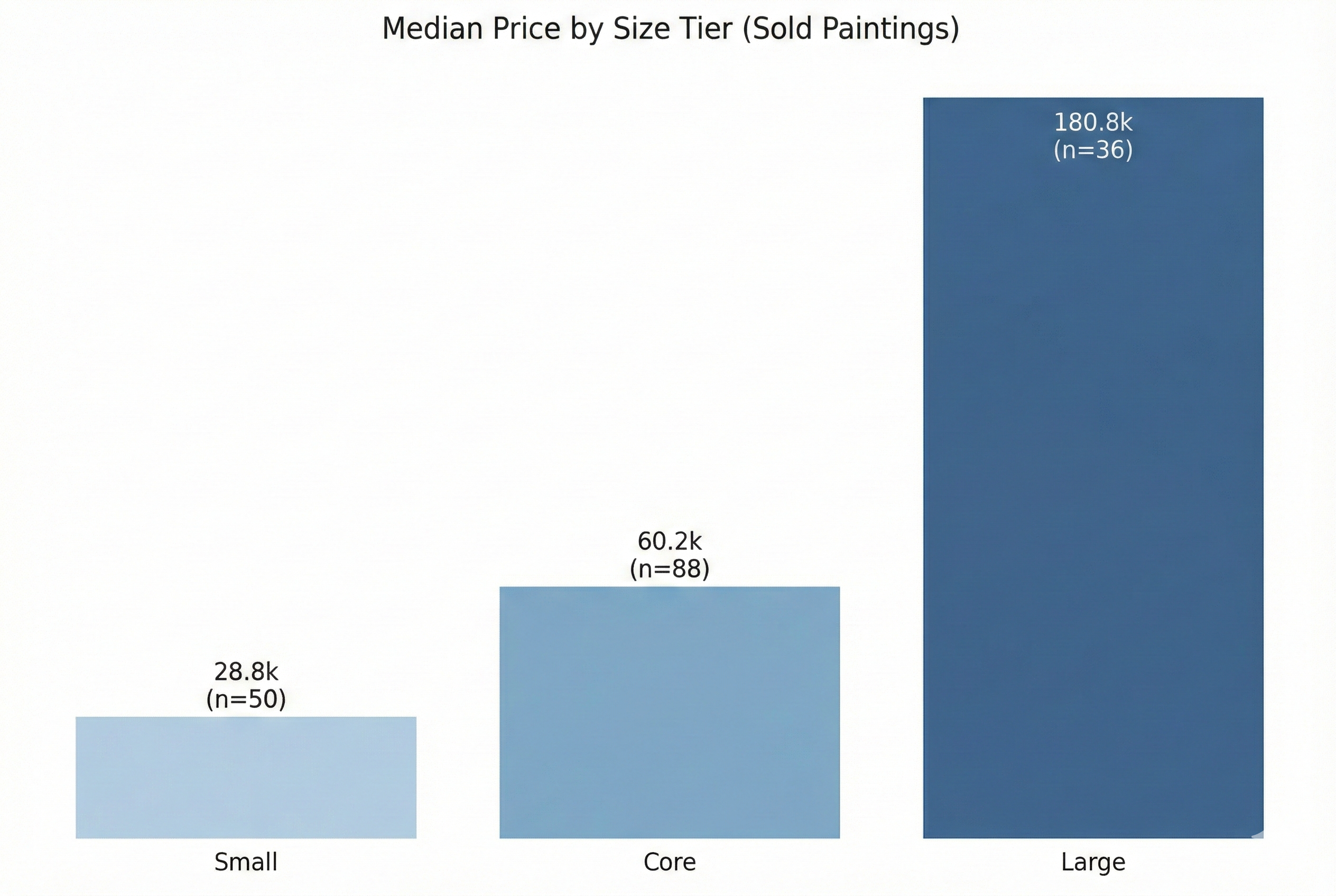

The hierarchy. Where liquidity sits, where the ceiling lives

The core of public trading sits in the “livable” painting formats that collectors can place at home. Think the kinds of oils Flash Art describes as small-to-medium landscapes and cityscapes, often with season and time-of-day titles. [2] This is where the median around US$52k gets built, and where the US$16k to US$96k middle band lives. The seller implication is practical. If your work is in this band, your outcome is driven less by “the market” and more by precision. Title, palette, surface, and paperwork decide whether you land at the top or bottom of that band.

The ceiling behaves differently. The top tier is dominated by large, resolved canvases that read as complete worlds. In this tape, large-format paintings have a median hammer price around US$181k. The seller implication is counterintuitive. You have more potential upside, but fewer credible exit routes. A top-tier work wants targeted placement and time. It does not want a generic sale slot where it must compete with a dozen other Italian paintings for oxygen.

The barometer. Small-format Salvos tell you how “risk-on” buyers feel

Every fast market has a sentiment gauge. For Salvo, it is the small-format painting segment. It trades frequently and it is where newer buyers learn what a Salvo “should” cost before they step up to La Valle or San Nicola Arcella. In this tape, there are 41 sold small-format paintings, typically oils on canvas, panel, board, or cardboard, with titles that often include Senza titolo and seasonal markers like Primavera. The implication is that this tier produces a lot of the visible price anchors that shape the rest of the market.

Salvo, Senza titolo, 1987. Image: © Archivio Salvo

In 2024, the median hammer price for this small-format segment was around US$48k. In 2025, it was around US$23k. That is a meaningful cooling, and it changes your routing decisions. When the small-format barometer is soft, buyers still chase trophy works, but they get stricter on everything else. Estimates that looked reasonable in a hot phase start to feel like traps.

What buyers reward. What gets punished

Buyers reward Salvo when the painting makes time feel tangible. That is the consistent thread across institutional framing and market demand. Mazzoleni describes the 1970s turn toward bright, simplified landscapes with a convincing specificity of dawn, daylight, dusk, or darkness, tied to his rendering of natural light. [6] Flash Art makes a similar point about titles that “resonate with the idea of time” and emphasise lighting conditions and seasons in small-to-medium oils. [2] Gladstone’s recent programming reinforces the travel and memory dimension. Real and imagined landscapes, shaped by movement across regions, become part of the work’s appeal. [4]

In auction terms, this means two things. First, titles that locate the painting in time or place often trade with more confidence than generic later “Untitled” pictures, because they are easier to narrate and easier to remember. Second, scale amplifies the effect. When Salvo’s light and architecture have room to breathe, buyers treat the work as a statement piece rather than a charming picture.

The punishments are usually quiet. “Passed” lots tend to appear when a work is priced as if it belongs to a higher tier than it actually does, or when paperwork leaves even one credible doubt. The Archivio exists to protect the market, and it can be strict. It can request further documentation or require direct analysis of the work. It also makes clear that payment for examination does not guarantee archiving or publication. [3] In practice, that means a seller who goes to market without clear Archivio documentation is volunteering to accept a discount.

Data needed. If you are missing the original Archivio Salvo certificate or any archive registration details, you need that file before you treat auction as a default channel. A copy of the certificate, any archive number, and clear images of front, back, and signatures are the documents that unlock the broadest buyer pool. [3]

Private sale for Salvo. Control is structurally rational here

A collector often thinks of private sale as a second choice. For Salvo, it is frequently the disciplined choice.

The reason is structural. Salvo’s auction market is liquid, but it is also a market where a public pass can become a permanent price anchor, especially in the small-format barometer segment. Private sale lets you keep the work out of the “public audition” cycle while you solve the two variables that buyers actually care about. Authenticity confidence and tier placement.

This fits the wider market context. The Art Basel & UBS Art Market Report shows dealers’ direct sales (online and in-person) accounting for 64% of dealer sales by value in 2023, signalling how much of the market’s serious business happens away from the rostrum. [9] Salvo is exactly the kind of artist where that matters. The most motivated buyers often already have a view on titles like Primavera and La Valle. What they want is access to the right work with the right paperwork, priced with discipline.

Inference: private placement is most powerful for Salvo when your work is either clearly top-tier, or hard to benchmark publicly. A large canvas that could credibly sit near the Il Mattino ceiling wants discretion and targeted buyer selection. A conceptual marble lapide, a photomontage self-portrait, or a rarer non-painting object may simply have too little comparable auction tape to risk a public swing. MACRO’s exhibition materials underline how broad his practice is beyond paintings. The market for those works can exist, but it requires specialist routing. [7]

Salvo, Io sono il migliore, 1970. Image: © Archivio Salvo

Data needed. If your work is from Salvo’s conceptual period or is a non-painting medium, you need documentation that can stand up in a private placement conversation. Exhibition history, publication references, and any correspondence with the Archivio are the files that turn “interesting” into “sellable.” [3]

Sell now vs wait. A calm framework

Sell now when your Salvo can be routed into its correct tier

If you own a Salvo that clearly belongs in the top half of the hierarchy, selling can be rational now. The ceiling is real, and it is already printed. Il Mattino proved that the market can clear around US$1.1m for a trophy painting in a global context. Large-format works also show a distinct pricing floor above the core market, with a median around US$181k in this tape. That combination gives you an asymmetric opportunity. You are not relying on a single miracle price. You are selling into an established tier.

This is when control matters most. You sell now by choosing the right channel, not by choosing the fastest channel. If your work is a title-forward landscape like Primavera or La Valle, with clean Archivio documentation, a planned private placement or a targeted auction slot can be a way to capture demand without donating optionality to a public estimate. [3] [6]

Wait when your Salvo sits in the barometer segment and you do not need liquidity

If your work is in the small-format tier that functions as the market’s sentiment gauge, waiting can be rational. In 2025, that segment’s median was around US$23k, after a meaningfully higher median in 2024. When the barometer is soft, buyers are still present, but they are more price-sensitive. That is exactly when a rushed sale can lock in a number that is more about mood than about quality.

Waiting is not passive here. It is preparation. You use the time to strengthen paperwork, refine positioning, and choose the buyer set. Gladstone’s continued programming, including exhibitions made in collaboration with Archivio Salvo, suggests that institutional and gallery visibility remains a real part of the demand engine. [4] [5] The point of waiting is to sell later from a position of strength, not to gamble on “the market coming back.”

Sell Salvo with Artscapy

You do not need a story. You need a plan that matches your Salvo.

1- Start with a 60-second estimate. Instant price range, backed by auction data refreshed every 24h.

2- Pick your path. Fast Sale (speed) vs Maximise Returns (advisor-led strategy).

- Fast Sale. Get a non-binding offer in 1–3 working days (where eligible).

- Or Maximise Returns. Choose private placement vs targeted auction vs hybrid. Strategy based on what your work actually is.

3- Close cleanly. 0% seller commission, transparent costs, escrow-protected. Payout within 7 days of collection (Fast Sale payout initiated same day once in our care).

Sources and references

[1] “Biography.” Archivio Salvo. n.d. Accessed 20 January 2026. https://www.archiviosalvo.com/en/biography.html

[2] “Salvo Gladstone 64 / New York.” Flash Art. 26 February 2020. Accessed 20 January 2026. https://flash---art.com/2020/02/salvo-gladstone-64-new-york/

[3] “Archive.” Archivio Salvo. n.d. Accessed 20 January 2026. https://www.archiviosalvo.com/en/archive.html

[4] “Salvo, in Viaggio.” Gladstone Gallery. Exhibition page. 2025. Accessed 20 January 2026. https://gladstonegallery.com/exhibit/salvo-in-viaggio/

[5] “Salvo.” Gladstone Gallery. Artist page. n.d. Accessed 20 January 2026. https://gladstonegallery.com/artist/salvo/

[6] “Salvo.” Mazzoleni. Artist page. n.d. Accessed 20 January 2026. https://mazzoleniart.com/elenco_artisti/salvo/

[7] “SALVO. Autoritratto come Salvo.” MACRO Museum. Exhibition page. 2021–2022. Accessed 20 January 2026. https://www.macromip.it/it/polifonia/salvo-autoritratto-come-salvo/

[8] “Boetti/Salvo. Living, Working, Playing.” MASI Museo d’arte della Svizzera italiana (LAC, Lugano). 2017. Accessed 20 January 2026. https://www.masilugano.ch/en/masi/in-corso/agenda/events/evento~mostre~2017~lac~boetti-salvo~.html

[9] “Dealers.” The Art Basel & UBS Art Market Report 2024 (Arts Economics). 2024. Accessed 20 January 2026. https://theartmarket.artbasel.com/the-art-market-2024/dealers

[10] Chow, Vivienne. “How the Late Italian Painter Salvo Went From Also-Ran to Market Star.” Artnet News. 2 April 2024. Accessed 20 January 2026. https://news.artnet.com/market/salvo-dreamy-landscape-paintings-are-now-art-markets-hot-properties-2446162