Sell art with confidence: A smarter way to deaccession a collection

Selling art is often described as a moment of opportunity. In reality, for many collectors—particularly those managing high-value works and private collections—it becomes a moment of uncertainty.

Unlike buying art—which is emotional, social, and surprisingly flexible—selling exposes the least transparent side of the market. Prices feel negotiable but unclear. Timelines stretch. Advice sounds persuasive but rarely precise. And the final outcome often looks very different from what the market headlines suggest.

Artscapy was built to change that experience for collectors stewarding significant artworks and private collections. This is not about rushing a sale or pushing works into the market. It is about giving collectors a clear, data-driven path to liquidity—without sacrificing value, discretion, or control.

Why selling art feels so difficult

Most collectors never plan their exit when they buy. Art enters a collection for many reasons: to live with it, to support artists, to build a legacy, or to grow long-term wealth. Selling only becomes relevant later—sometimes unexpectedly. When that moment arrives, collectors often discover that the market offers very few clear answers.

Auction results show impressive prices, but rarely reflect what sellers actually receive once fees are deducted. Private dealers promise discretion, yet pricing and timelines remain fluid. Comparable data is discussed selectively. Decisions are framed as matters of judgement rather than evidence. What collectors are really missing is structure.

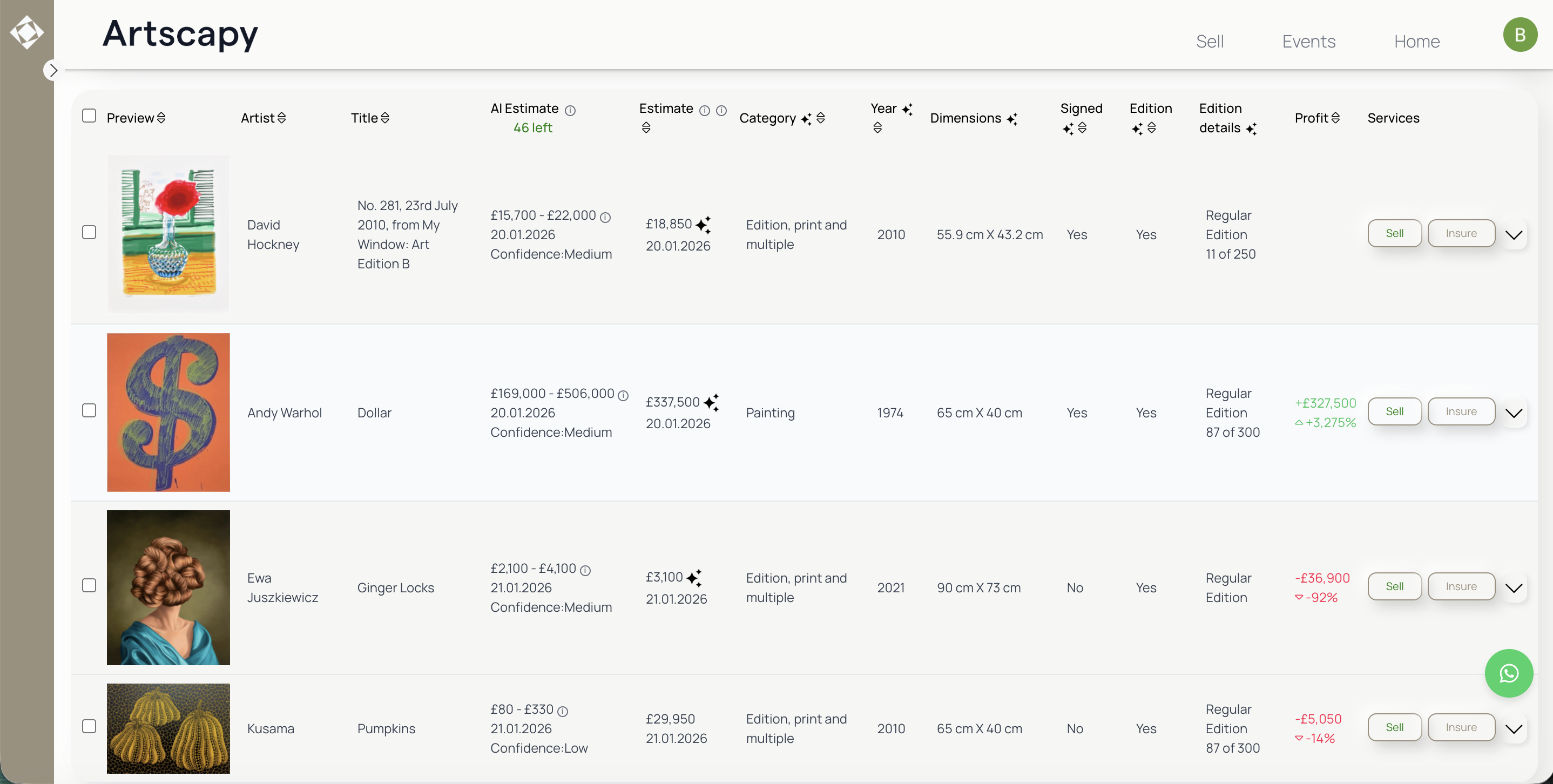

Artscapy portfolio dashboard showing AI-powered estimates.

A different way to deaccession art

Artscapy approaches art sales the way modern markets approach any meaningful transaction: with data first, strategy second, and execution only once the path is clear. Every deaccessioning process begins with an AI-powered market estimate. This is not an opinion or a pitch. It is a data-driven reference point built on real transaction history and current market signals. It allows collectors to understand where their artwork realistically sits in today’s market before any exposure takes place.

From there, Artscapy works closely with the collector—often families, estates, and private collection owners—to define the right strategy. Sometimes the optimal outcome is a private placement into another collection. In other cases, an auction may deliver the highest value—if timed correctly and structured properly. The key difference is that the channel is chosen deliberately, not by default. Throughout the process, collectors remain informed, not managed at arm’s length. Pricing logic, timelines, and next steps are clear from the start.

Efficient outcomes for high-value works, without forcing the market

Speed in art sales is often misunderstood. Moving quickly does not mean discounting or rushing exposure. It means removing uncertainty. When pricing is accurate and the right buyers are targeted from the outset, transactions tend to happen naturally.

More than 90% of artworks sold through Artscapy are completed in under 40 days—from consignment to client payout—even at the higher end of the market. That efficiency comes from preparation, not pressure. Collectors know where they stand, how long the process is likely to take, and what success realistically looks like.

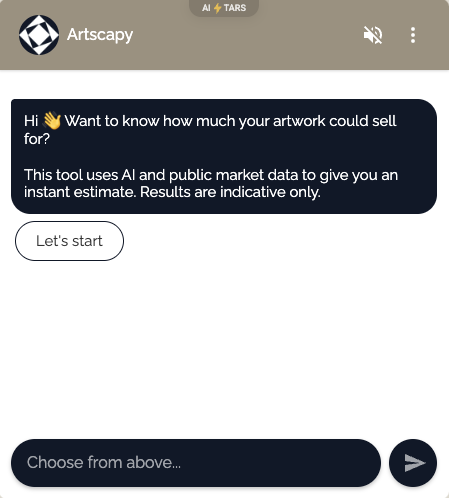

Artscapy’s AI estimate. Try it here.

Discretion comes as standard for private collections

Many collectors—particularly those with significant or closely held collections—hesitate to sell because they fear public exposure. Artscapy is designed for discretion. Works are never made public unless the client explicitly agrees. In most cases, artworks are placed privately into other collections via our art advisory team, preserving confidentiality and protecting long-term value. This controlled approach also reduces the risk of overexposure—a common issue when works are pushed unsuccessfully into public channels.

Avoiding the risk of “burning” an artwork

In the art world, a work is considered “burned” when it is publicly offered and fails to sell. Once that happens, future buyers anchor to the failure, and value can be impaired for years. Artscapy’s process is designed to prevent this. By aligning pricing, timing, and channel selection before any exposure, each artwork enters the market with the highest possible chance of success—and without unnecessary risk.

Deaccessioning a collection, without the guesswork

Selling art does not need to feel like stepping into the unknown. With Artscapy, collectors gain access to a structured, transparent sales process that combines market data, strategic advice, and fully managed execution. The result is clarity, speed, and confidence at the moment it matters most.

Whether you are rebalancing a private collection, funding a new acquisition, managing estate transitions, or simply exploring your options, Artscapy helps you deaccession artworks on your terms—quietly, efficiently, and with outcomes grounded in reality.